ESR in UAE is a percept in the UAE’s tax framework, introduced from January 1st, 2019, that applies to all businesses, including onshore companies, free zone companies, non-partnership companies, and partnership firms. Every licensee must comply with the Economic Substance Regulations UAE Notification, through which they report to the Regulatory Authority on the current status of their business’ profits. The primary purpose of the economic substance notification form is to ensure that the companies’ profits are in accordance with the entirety of economic activities in the UAE.

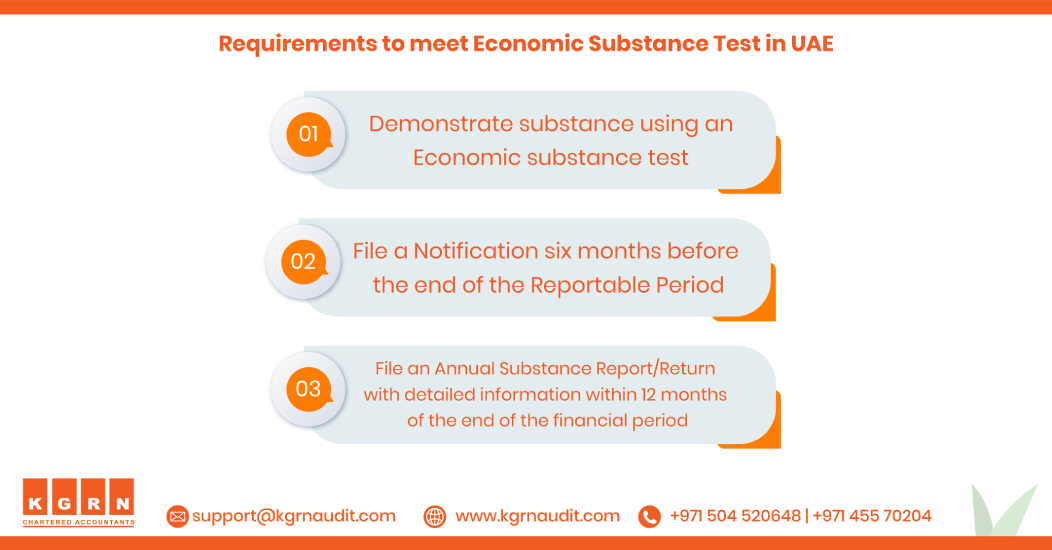

Every licensee must submit an Economic Substance Regulations UAE form and report electronically in the official portal of UAE’s Financial Ministry. Though licensees aren’t necessary to file an Economic Substance Report or satisfy the Economic substance test, they must file an Economic Substance Regulation Notification form irrespective of their annual turnover and profits from relevant activities. Licensees will have to pay a penalty of around AED 20,000 if they fail to submit the ESR notification form before the stipulated time.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

The economic substance regulations notification form, UAE, is a crucial step before the filing of the Annual Economic Substance Regulatory report. Economic substance regulations have great relevance in countries with low or no corporate taxes, as these regulations bring order to their tax system. The Economic Substance Regulations UAE Form curbs illegal tax practices like tax avoidance and tax evasion and brings a decree to the country’s economic cycle.

At KGRN, we have a team of specialists who are well-versed in their fields, have a lot of expertise, and are always ready to provide legal advice for any questions you may have regarding your business. Furthermore, we are committed to providing outstanding service around the clock and places a great focus on ensuring the complete happiness of our customers. Please get in touch with our experts if you require any additional information regarding the Economic Substance Regulations and the obligations that they impose.

For more detailed information about ESR, Visit: Economic Substance Dubai Guidelines

Related Posts

Accounting and bookkeeping services in Dubai

Economic substance regulation UAE

ADNOC ICV Certification Agencies

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae