What Is Economic Substance Regulation(ESR) in UAE?

The UAE is a member of the OECD Inclusive Framework. As a result, the EU assessed the UAE’s tax framework, through the European Union (“EU”) Code of Conduct Group on Business Taxation. Therefore, to obtain a better rating, and improve operations, the UAE introduced a Resolution on the Economic Substance. Hence, the ESR guidelines came into force via Cabinet of Ministers Resolution No.31 of 2019, the “Regulations” on 30 April 2019. The guidance that provides further clarity on the application of the Regulations -ESR was issued on 11 September 2019. Hence, eligible companies now comply with the by-laws stated in ESR compliance UAE. Further guidelines regarding the compliance requirements are a part of Economic Substance Dubai and UAE ESR compliance.

Scope of the ESR in UAE

In this case, the scope of the Dubai Economic Substance Regulations – According to Economic Substance Act, the ESR regulation applies to all licensees. Incidentally, this includes all those who have a commercial license, incorporation certificate or any type of license that is necessarily taken from the licensing authority in doing the business. Subsequently, going with the spirit of the law and the provisions, it is interpreted that the Free Zone includes Offshore Companies as well. Furthermore, most of the Arab countries have accepted these guidelines, making them prevalent throughout the Gulf. For instance, the Economic Compliance Sharjah Act ensures that the same guidelines are in force in Sharjah, just like the UAE.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

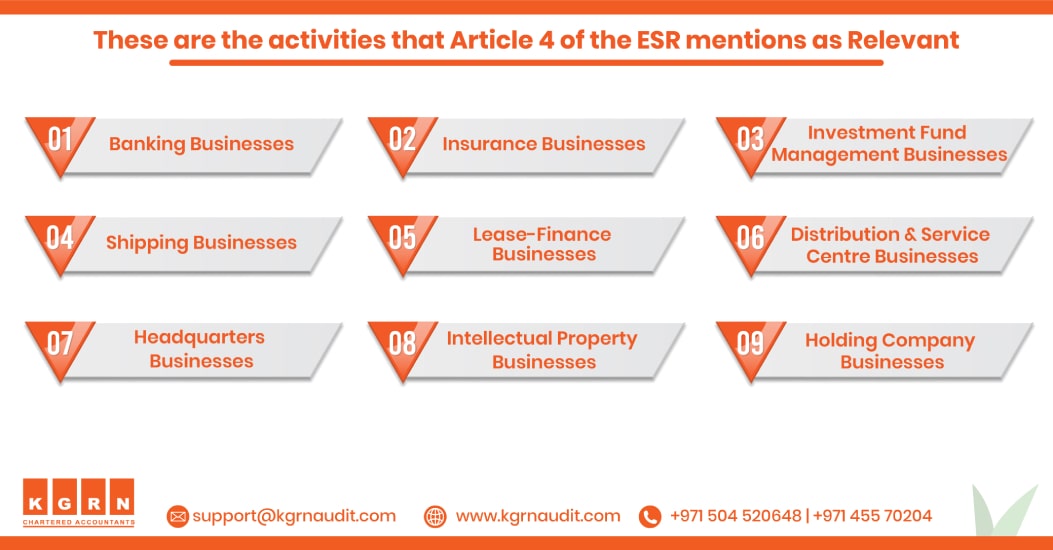

What are Relevant Activities In UAE?

In this case, the FHTP (Forum on Harmful Tax Practices) has acknowledged the geographically mobile activities for requirements of the substance. According to ESR Compliance UAE, the following are the activities falling into this category:

- Banking Business

- Insurance Business

- Lease-finance Business

- Headquartered Business

- Shipping Business

- Holding Company Business

- Intellectual Property Business

- Investment Fund Management

- Distribution and Service

Deadlines For Notification

According to the Economic Substance Dubai, the following are the due dates by which to submit the ESR form.

DIFC – 31st March 2020

JAFZA – 31st March 2020

DAFZA – 03rd May 2020

RAKICC – 30th June 2020

AFZ – 30th June 2020

DMCC – 30th June 2020

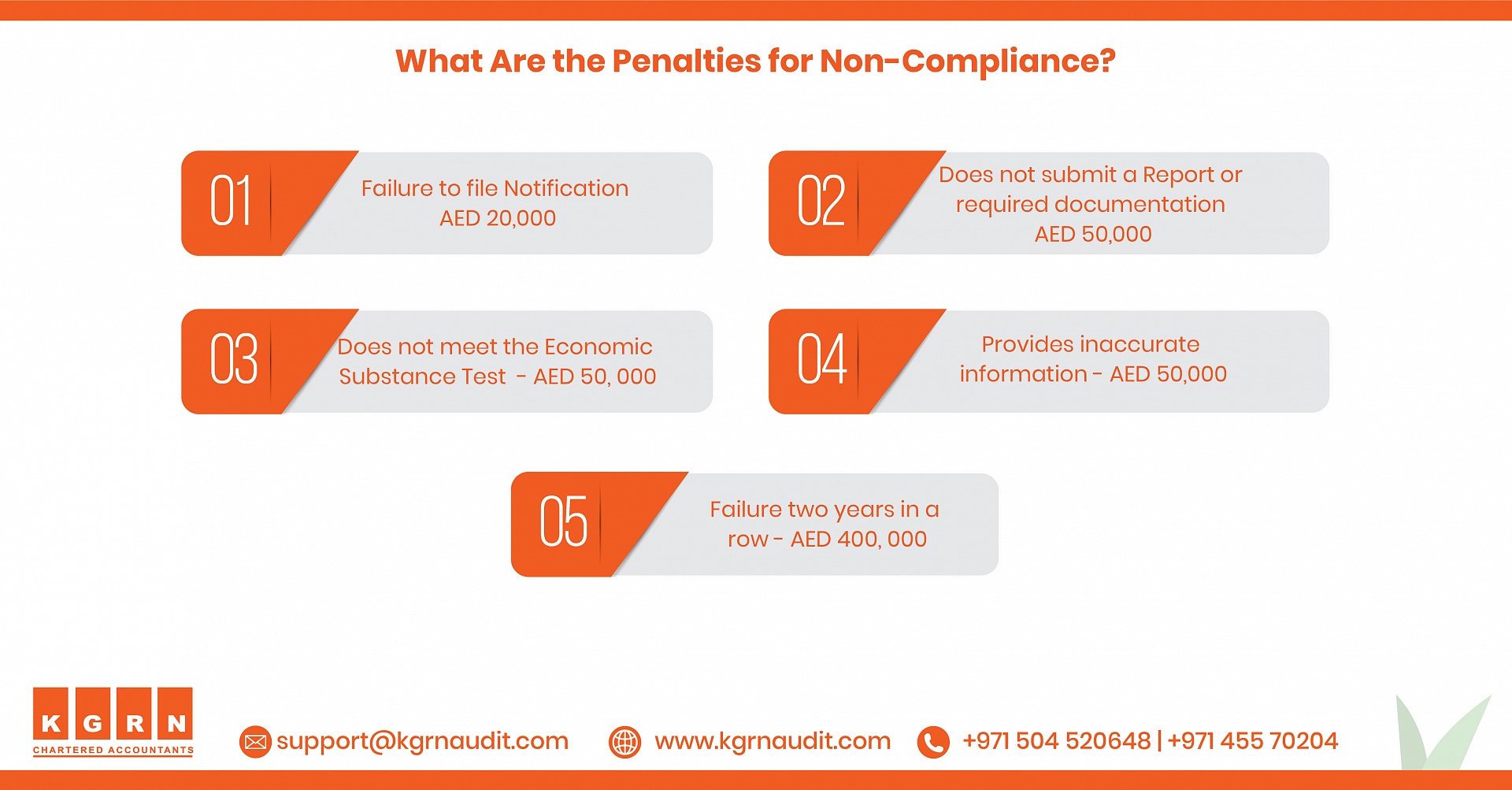

Penalties For Failure to Comply

Economic substance regulations Dubai

Also, the penalties for failing to notify the regulatory authority are between AED 10,000 – and AED 50,000. Similarly, other penalties Apply if Licensees Fail to Provide Accurate Or Complete Information And Demonstrate Sufficient Economic Substance in the UAE.

How can KGRN Chartered Accountants help?

KGRN Chartered Accountants can help you get a clear understanding of the new economic substance regulations in the UAE. Furthermore, KGRN Chartered Accountants can conduct an impact analysis – studying and analyzing the effect of the new economic substance regulations – ESR on your existing businesses in the UAE. Additionally, our team can help you rectify errors to ensure complete compliance. Also, years’ worth of experience helps our team efficiently and effectively manage your records.

As a result, we can identify gaps in the level of economic substance in affected entities and consider remediation options where gaps are identified. Hence, KGRN Chartered Accountants can assist in relevant compliances under the new regulations.

For more info please contact :

Contact Person: Gopu Rama Naidu CPA FCA

Email: [email protected] Mobile : +971 50 452 0648 Phone: +971 455 70 204

—–

More Info about ESR in UAE

- Things To Know About UAE Economic Substance Regulations

- Guide For UAE Economic Substance Regulations

- Economic Substance Regulations(ESR) in UAE – Extended Deadlines For Notifications

- Economic Substance Test UAE

Our Services

- Audit firms in Dubai

- Audit services in Dubai

- Accounting firms in Dubai

- Accounting services in Dubai

- Bookkeeping services Dubai

- ICV certificate

- ADNOC ICV Certification Agencies

- Internal Audit Firms in Dubai

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae