The idea of the business movement that you mean to do will affect choosing the Free Zone to meet your prerequisites.

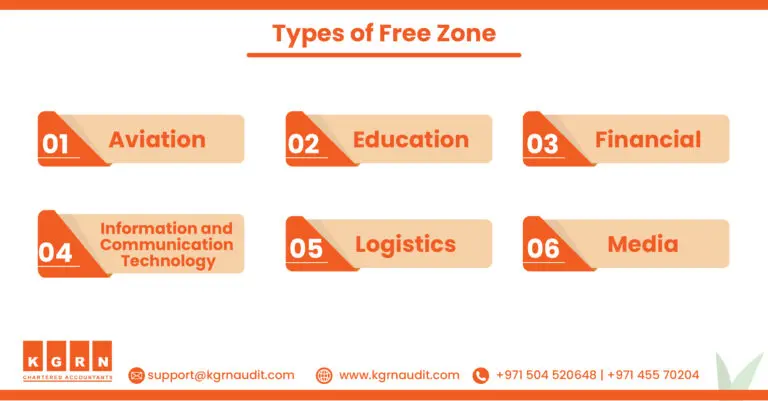

The chief Free Zones and their permit exercises include:

Dubai Multi Commodities Center (DMCC) – Commodities Trade and Exchanges

Jebel Ali Free Zone (JAFZA) – Trading, General Trading, Service, Logistics and Industrial

Dubai International Financial Center (DIFC) – Banking, Financial Services and Legal

Dubai World Central (DWC) – Aviation, Logistics, Light industry, and Ancillary Services

Dubai Knowledge Park (DKP) – Human Resources Management, Training, and Personal Development

Dubai Internet City (DIC) – Internet and Communications Technology

Dubai Media City (DMC) – Media related exercises

Dubai Silicon Oasis (DSO) – Information Technology, Telecom, Electronic and Engineering

Dubai Healthcare City (DHCC) – Healthcare, Medical Education and Research, Pharmaceuticals and Medical Equipment

Ras Al-Khaimah (RAK) – Trading, General Trading, Service, Industrial, and Educational

Fujairah Creative City (FCC) – Media, Consulting, Communications, Design, and Technology.