Economic substance is a percept in the UAE’s tax framework, introduced in the UAE from January 1st, 2019, that applies to all businesses, including onshore companies, free zone companies, non-partnership companies, and partnership firms. According to Article 4 of Economic Substance Regulations in UAE, every licensee must submit an Economic Substance Regulations UAE form. They can file their periodical report electronically in the official portal of UAE’s Financial Ministry.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

ESR UAE: Relevant Activities

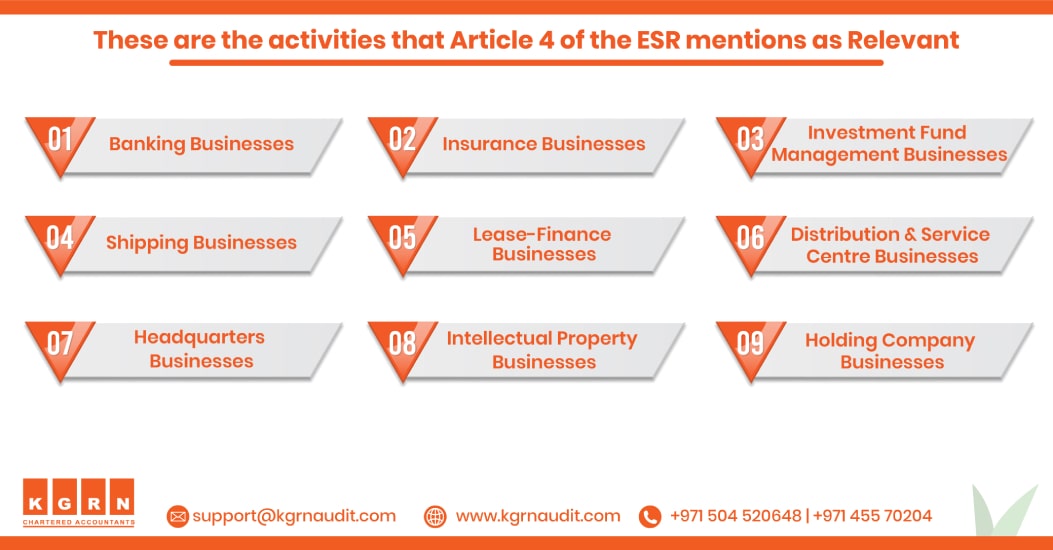

Article 4 is the governing factor on the regulations of the Economic Substance Regulations in the UAE. It mentions the activities that the law identifies as ‘Relevant activities’. The following are the activities that Article 4 of the Economic Substance regulation in the UAE mentions as Relevant:

- Banking Businesses

- Insurance Businesses

- Investment Fund Management Businesses

- Shipping Businesses

- Lease-Finance Businesses

- Distribution & Service Centre Businesses

- Headquarters Businesses

- Intellectual Property Businesses

- Holding Company Businesses

You can recognize the above businesses as licensees. And, they must file their Economic Substance Regulations notification form, UAE.

The economic substance regulations form has to be submitted within the financial year, irrespective of the company’s annual turnover and accumulated profits. Article 4 of the Economic substance regulations form states that the provisions of the law do not apply to companies or businesses in which the Emirati Government or the Federal government has any direct or indirect ownership of over 51% share.

Why is economic substance regulations so important for UAE businesses?

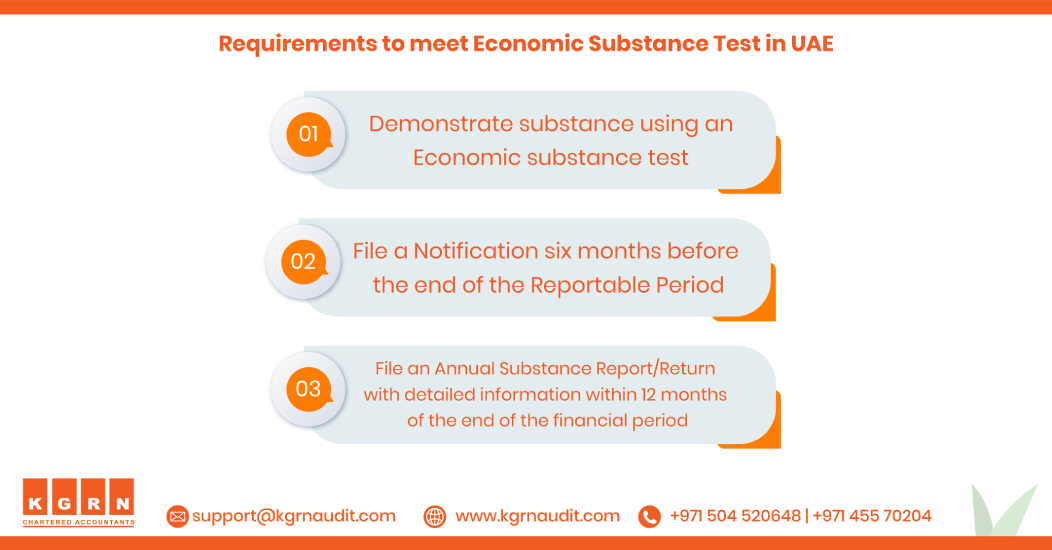

In order for businesses to identify activities that are pertinent to their operations, they are need to scrutinise all transactions with caution and vigilance, and they must do so using a methodology that prioritises substance over form. First, you need to have an understanding of the organisational structure and business model, and then you need to assess whether or not the Relevant Activity is relevant before you can file the ESR Notification. For the majority of free zones and mainland companies, the deadline for reporting ESR Notification was June 30, 2020. This deadline applied to the reportable period that began on January 1, 2019, and ended on December 31, 2019. There are a few free zones that have extended the deadline to the 31st of July in the year 2020.

If money is earned from the relevant activity during the reportable period, all licensees must meet the return filing requirements. Licensees must compute income and prepare financial statements in order to compute operational expenses, net profits, and assets held only for relevant activity.

Compliance is required, and records and information must be kept for each reporting period. Noncompliance with the Economic Substance Regulations will result in not only monetary fines, but also the suspension or revocation of the licence, which could cause serious disruptions.

How KGRN can help you file ESR in UAE?

KGRN has a team of well-experienced and knowledgeable professionals who are always ready to provide legal assistance for your business-related queries. We provide excellent service round the clock and consider customer satisfaction as our highest priority. Contact our team for further details on Economic Substance Regulations UAE reporting and its obligations.

For more Detailed information about ESR, Visit: Economic Substance Dubai Guidelines

For enquiries and clarification on ESR, call +971 45 570 204 / E-mail: [email protected]

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae