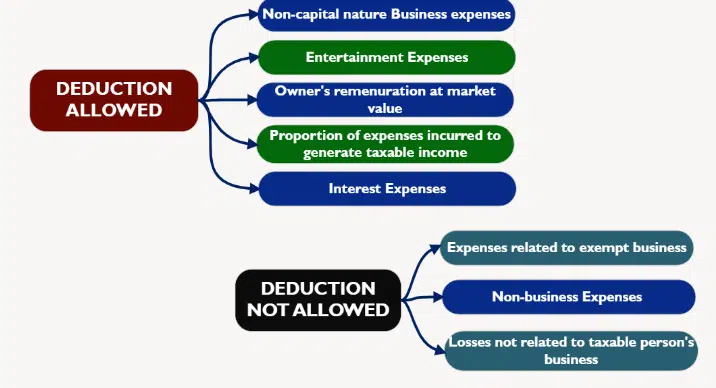

Deductible Expenses–(Article 28)

Interest Expenses

Entertainment Expenditure –(Article 32)

50% of entertainment expenses are deductible. Entertainment include the followings:

a) Meals.

b) Accommodation.

c) Transportation.

d) Admission fees.

e) Facilities and equipment used in connection with such entertainment, amusement or recreation.

Non-Deductible Expenses–(Article 33)

- Donations, grants or gifts to a non-qualifying Public Benefit Entity.

- Fines and penalties

- Bribes or other illicit payments.

- Dividends, profit distributions to the owner of the Taxable Person.

- Amounts withdrawn by taxable natural person or partner in unincorporated partnership.

- Corporate Tax imposed

- Recoverable Input VAT.

- Tax on income imposed on the Taxable Person outside the Stat

Contact us at @ +971 45 570 204 / Email Us : [email protected], and one of our Corporate tax specialists will provide you with necessary support and consultation.

FAQ

What expenses are deductible?

In principle, all legitimate business expenses incurred wholly and exclusively for the purposes of deriving Taxable Income will be deductible, although the timing of the deduction may vary for different types of expenses and the accounting method applied. For capital assets, expenditure would generally be recognised by way of

depreciation or amortisation deductions over the economic life of the asset or benefit.

Expenditure that has a dual purpose, such as expenses incurred for both personal and business purposes, will need to be apportioned with the relevant portion of the expenditure treated as deductible if incurred wholly and exclusively for the purpose of the taxable person’s business. Certain expenses which are deductible under general accounting rules may not be fully deductible for Corporate Tax purposes. These will need to be added back to the Accounting Income for the

purposes of determining the Taxable Income. Examples of expenditure that is or may not be deductible (partially or in full)

include:

Contact us at @ +971 45 570 204 / Email Us : [email protected], and one of our Corporate tax specialists will provide you with necessary support and consultation.

Related Topics

What is the taxable and exempt income for corporate?

Tax Base Analysis of Corporate Tax in UAE

Guide to Registration and Deregistration of Corporate Tax in UAE

Who is exempt from UAE corporate tax?

Taxable Person as per Corporate Tax Law in UAE

Significant CD, MD, and FTA Decisions related to Corporate Tax in UAE