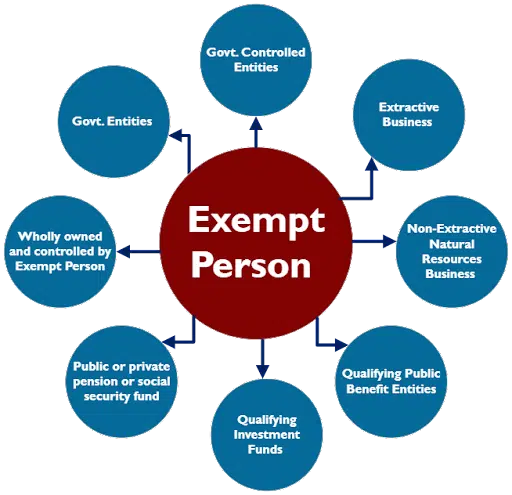

Government Entities – Exceptions (Article 5) (automatic exemption)

- It conducts a Business or Business Activity under a License issued by a Licensing Authority.

- Under a Licence issued by a Licensing Authority, it shall be treated as an independent

Business, and shall keep financial statements for this Business separately from the Government Entity’s other activities. - It shall calculate the Taxable Income for its Business or Business Activity independently for each Tax Period, in accordance with the provisions of this Decree-Law.

- Transactions between the Business or Business Activity this Article and the other activities of the Government Entity shall be considered Related Party transactions subject to the provisions of Article 34 of this Decree-Law.

- It may apply to the Authority for all its Businesses and Business Activities to be treated as a single Taxable Person for the purposes of this Decree Law

Government Controlled Entities that are specified in a Cabinet Decision – Exceptions (Article 6) (automatic exemption)

- It conducts a Business or Business Activity under a License issued by a Licensing Authority.

- Under a Licence issued by a Licensing Authority, it shall be treated as an independent Business, and shall keep financial statements for this Business separately from the Government Entity’s other activities.

- It shall calculate the Taxable Income for its Business or Business Activity independently for each Tax Period, in accordance with the provisions of this Decree-Law.

- Transactions between the Business or Business Activity this Article and the other activities of the Government Entity shall be considered Related Party transactions subject to the provisions of Article 34 of this Decree-Law.

- It may apply to the Authority for all its Businesses and Business Activities to be treated as a single Taxable Person for the purposes of this Decree Law

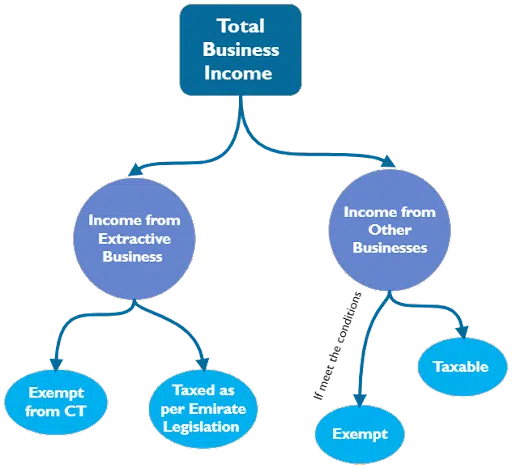

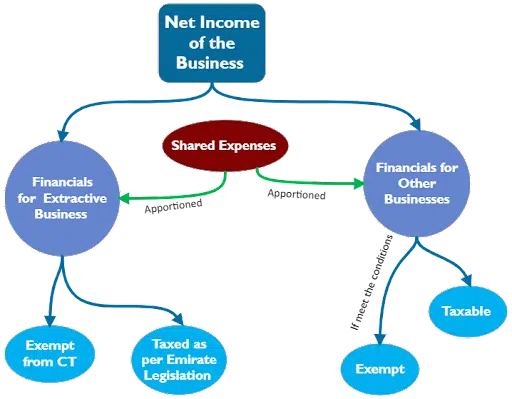

Extractive Business – CONDITIONS (Article 7)

a. The Person directly or indirectly holds or has an interest in a right, concession or Licence issued by a Local Government to undertake its Extractive Business.

b. The Person is effectively subject to tax under the applicable legislation of an Emirate in accordance with the provisions of Clause 6 of this Article.

c. The Person has made a notification to the Ministry in the form and manner agreed with the Local Government.

Extractive Business – CT Application (Article 7)

Extractive Business – CT Application (Article )

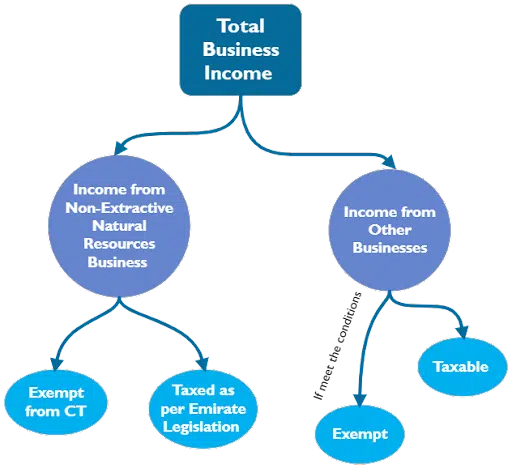

Non-Extractive Business – Conditions (Article 8)

a. The Person directly or indirectly holds or has an interest in a right, concession Licence issued by a Local Government to undertake its Non-Extractive Natural Resource Business in the State.

b. The Person’s income from its Non-Extractive Natural Resource Business is derived solely from Persons that undertake a Business or Business Activity.

c. The Person is effectively subject to tax under the applicable legislation of an Emirate

d. The Person has made a notification to the Ministry in the form and manner agreed with the Local Government.

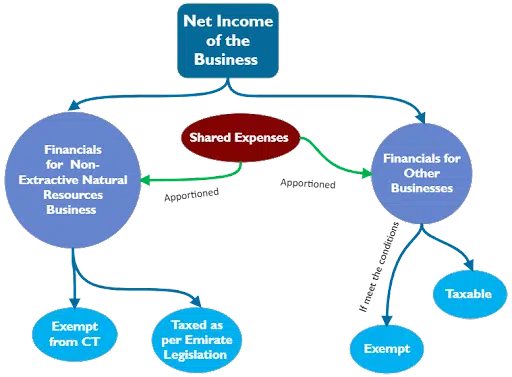

Non-Extractive Business – CT Application (Article 8)

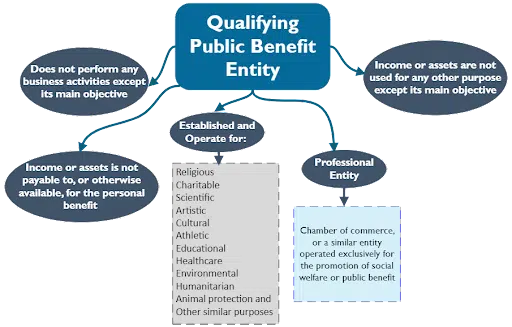

Qualifying Public Benefit Entity Listed in the Cabinet Decision–(Article 9)

Qualifying Investment Fund –(Conditions: Article 10)

a. The investment fund/fund’s manager is subject to the regulatory oversight of a competent

authority;

b. Interests in the investment fund are traded on a Recognized Stock Exchange or are marketed

and made available sufficiently widely to investors.

c. The main or principal purpose of the investment fund is not to avoid Corporate

Qualifying Free Zone Person–(Conditions: Article 18)

a. Maintain adequate substance

b. Derives Qualifying Income

c. No election to be subject to 9%

d. Meets Transfer Pricing requirements

e. Comply with Related party transaction

rules

Qualifying Free Zone Person–(Election: Article 19)

Can make an election to be subject to Corporate Tax at 9%

The election will be effective from:

- The commencement of the Tax Period in which the election is made or

- The commencement of the Tax Period following the Tax Period in which the election was

made.

Contact us at @ +971 45 570 204 / Email Us : [email protected], and one of our Corporate tax specialists will provide you with necessary support and consultation.

FAQ

What income is exempt?

The Corporate Tax Law also exempts certain types of income from Corporate Tax. This means that a Taxable Persons will not be subject to Corporate Tax on such income and cannot claim a deduction for any related expenditure. Taxable Persons who earn exempt income will remain subject to Corporate Tax on their Taxable Income.

The main purpose of certain income being exempt from Corporate Tax is to prevent double taxation on certain types of income. Specifically, dividends and capital gains earned from domestic and foreign shareholdings will generally be exempt from Corporate Tax. Furthermore, a Resident Person can elect, subject to certain conditions, to not take into account income from a foreign Permanent Establishment for UAE Corporate Tax purposes.

Related Topics

Taxable Person as per Corporate Tax Law in UAE

Top Audit Firms in Dubai, UAE 2023

Significant CD, MD, and FTA Decisions related to Corporate Tax in UAE