Welcome to KGRN Tax Consultancy Services, your number one source for all things in Tax Consultancy services. We’re dedicated to giving you the very best of your Tax Consultancy works, with a focus on Professional Document, Enhanced Professional Support / Services, 24/7 Dedicated Team Supports and More. KGRN Tax Consultancy Services has come a long way from its beginnings in UAE. We now serve customers all over Dubai, Abu Dhabi, Sharjah and are thrilled that we’re able to turn our passion into our website. If you have any questions or comments, please don’t hesitate to contact us.

Tax Consultancy Services

Tax Consultancy in Dubai

Choosing a tax advisor for any firm is a choice of improvement as they assume the liability of managing the tax structure of your business. If you have quite recently begun your business or want to extend it in the universal market, it ends up being a beneficial choice.

Tax advisors design and give basic data and investigate each part of the business while managing the tax forms. A portion of the advantages that an association appreciates by picking a tax expert include:

- Tax Consultants Help to Recognize Legitimate Approaches to Cover Less Tax

- Saves Time in Setting Up the Tax Forms

- Evaluates Risks and Protects Assets

Best Tax Consultancy in UAE

We will take care of your Tax Consultancy and take the load off you.

The business foundation is a hazardous procedure and Tax filing is viewed as one of the hardest activities on earth. The procedure turns out to be progressively mind-boggling when it has to manage foreign affairs relationships and pursue global taxation approaches. To battle this, a business requires a Strategy for taxation risk.

This methodology ought to be by the corporate system and ought not to be disengaged from the business structure and ought to incorporate thorough arranging and distinguishing proof of Tax risk advisory in Dubai. Building a Tax technique encourages a business substance to look at the Tax circumstance upon necessity.

Understanding the advantages of a brought together taxation in UAE, the nation has re-surrounded its Tax structure to be increasingly appropriate for the financial specialists and business visionaries everywhere throughout the world. This progression was exceptionally vast for the administration of the United Arab Emirates as this would help the economy of the nation as well as help draw in more business visionaries to the nation.

Tax is a required commitment that is paid by the residents of any country to the administration with the goal that it can give the basic public services. It is material to the two nationals just as ex-pats. At the point when a business gets built up in a foreign country, the installment of corporate Tax turns into an impulse.

Likewise, people acquiring within the Tax slab of any country needs to pay individual annual Tax dependent on the guidelines of that particular nation. Now, selecting a Tax advisor goes about as a superior alternative that makes us mindful of the taxation arrangement of the particular country.

A Tax consulting services in dubai specialist is an individual or an association who helps business substances and people to comprehend and manage the taxation structure and uncover the lawful methods for settling less Tax.

Dubai, one of the quickest creating urban communities of the world and the core of the UAE, has been a focal point of fascination for businesses internationally. Be it a beginning up, or a built-up business, one of the principal urban areas that snaps in the brain of a businessperson is Dubai, the explanation being that the emirate offers different tax-free zones that pull in tax specialist from each side of the world. We should have a more profound look.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Choosing a tax advisor for any firm is a choice of improvement as they assume the liability of managing the tax structure of your business. If you have quite recently begun your business or want to extend it in the universal market, it ends up being a beneficial choice.

Tax advisors design and give basic data and investigate each part of the business while managing the tax forms. A portion of the advantages that an association appreciates by picking a tax expert include:

• Tax consultants help to recognize legitimate approaches to cover less tax

• Saves time in setting up the tax forms

• Sorts the entangled calculations

• Strategies are worked to limit the tax to be paid

• Up-to-date data is gotten in regards to any adjustments in the taxation arrangement

Since Excise Tax identifies with the uncommon goods, businesses managing these products ought to experience the Excise tax Registration process that incorporates makers, shippers, stockpiles, and distribution center attendants of Excise goods.

Strategies for Charging Excise Tax

Excise tax can be taxed using any of the accompanying techniques:

1. Specific Excise Tax

Here, the tax consultancy in Dubai is taxed by amount, independent of cost or weight.

2. Ad-Valorem Excise Tax

Here, the tax is taxed thinking about a particular rate on the estimation of the item.

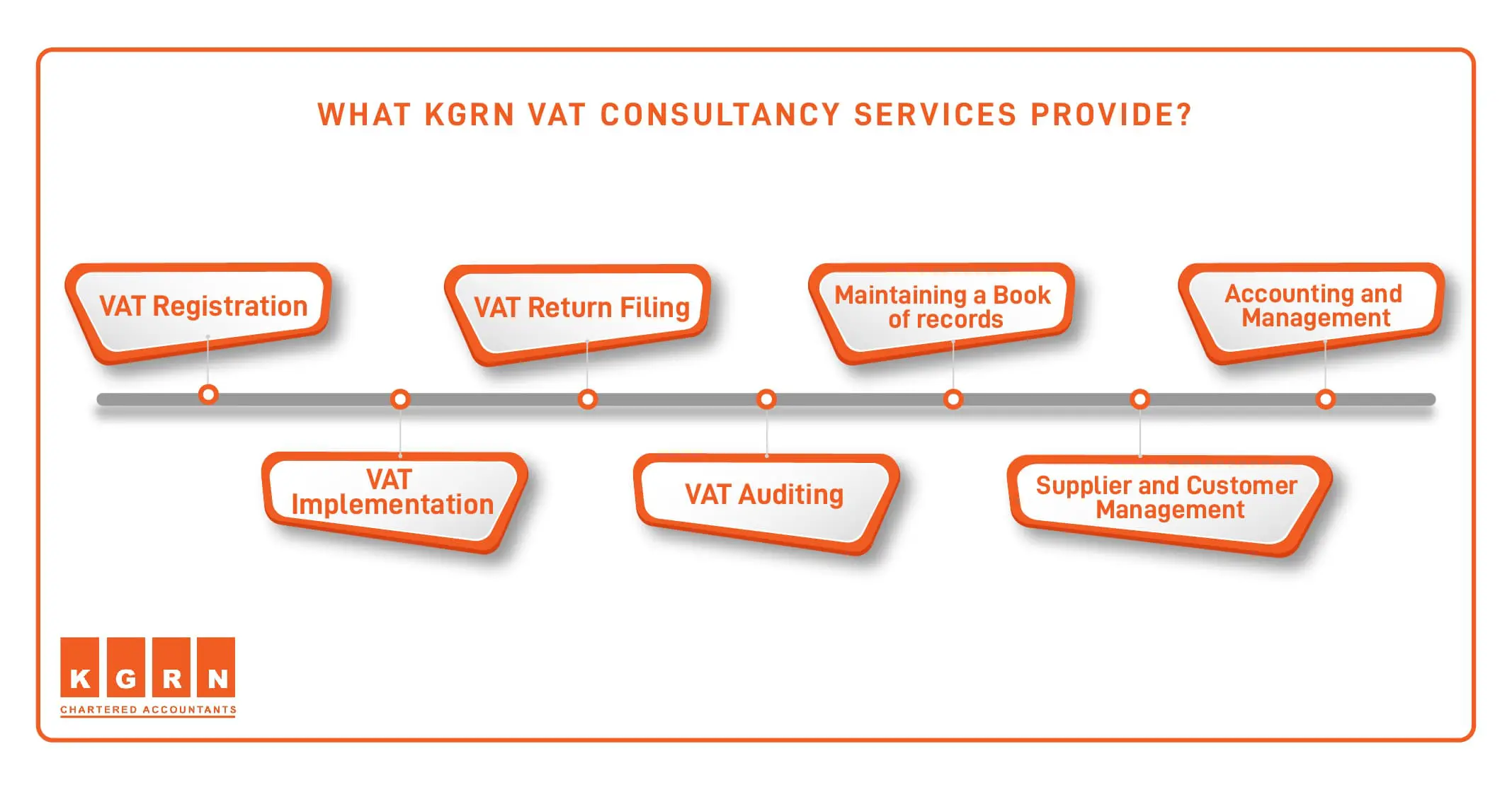

As a tax specialist our services incorporates the accompanying yet not restricted to it:

- VAT Registration Service | VAT Group Registration Services

- Preparing and submitting VAT Returns for you

- To keep up significant records identified with tax transactions

- Liaison with FTA on your tax-related issues

- Represent you before FTA if any question or explanation required

- Respond to the FTA for your benefit if Tax Audit | Taxation is led

- Arrange or set up the reports for the FTA during the tax review | taxation

- To submit demand for reexaminations on the choices made by the FTA

- To continue with de-registration for your sake whenever required

Taxation in UAE

Dubai is known for being a Tax-free business zone. As a general rule, various kinds of Taxes get applied in businesses, as:

Direct Taxes

• Companies working in the oil and gas industry in Dubai and the remainder of the UAE: 55%

• Branches of foreign banks working in Dubai and the remainder of the UAE: 20%

Indirect Taxes

• Municipal tax on hotels and entertainment offices: 10%

• Municipal tax on the rental of business space: 10%

• Municipal tax on the rental of private property in Dubai and the remainder of the UAE: 5%

• Value Added Tax (VAT): 5% (much of the time)

Double Tax Treaties

Since the business at a worldwide level takes between various countries, going into Double Tax bargains turns into a bit of leeway. A Double Tax settlement is an understanding that is marked by two nations to dodge Double taxation on both sides and urge to create business relations between countries. The Emirates has more than 70 Tax settlements with various nations that turn into an additional incentive to contribute the within as a business center point.

Globalization has published doors for businesses to convey their business activities at a worldwide level, crosswise over national limits. The business transactions bring about the import of limited goods during the procedure. Presently, a few sorts of duties are required on these products.

One such type is the Excise tax. It is a tax levied on the import of limited goods that are unsafe to human health. To benefit of these services, and Excise tax registration should be done according to the law.

The GCC nations are required to acknowledge the structure with various rates for an alternate scope of items so the business activities will be directed on a legitimate premise. The unique goods incorporate Tobacco Product, carbonated soda pops, and particular reason products that are accepted to effectively affect human health.

Excise tax is eventually borne by the last customers however is gathered at a prior stage in the chain. The primary highlights of Excise tax are:

• It is mostly imposed on the utilization of goods

• It is applied to uncommon products

• It is demanded either during the creation arrange or the import organize

• It is gathered by business for the benefit of the tax authority