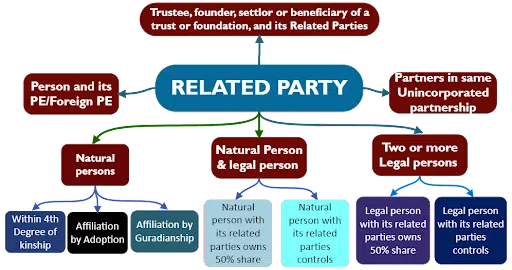

Related Parties–(Article 35)

Transactions between Related Parties–(Article 34)

Arm’s length rule

The arm’s length result of a transaction or arrangement between Related Parties must be determined by applying one or a combination of the following transfer pricing methods:

a. The comparable uncontrolled price method.

b. The resale price method.

c. The cost-plus method.

d. The transactional net margin method.

e. The transactional profit split method.

In order to determine the transfer pricing methods following factors must be considered:

a) The contractual terms of the transaction or arrangement.

b) The characteristics of the transaction or arrangement.

c) The economic circumstances in which the transaction or arrangement is conducted.

d) The functions performed, assets employed, and risks assumed by the Related Parties are entering into the transaction or arrangement.

e) The business strategies employed by the Related Parties entering into the transaction or arrangement.

Payments to Connected Persons –(Article 36)

- Deductible only at market value

2. The connected person includes:

- Owner of the taxable person

- Director or officer of the taxable person

- Any related party of the owner or director or officer of the taxable person

Contact us at @ +971 45 570 204 / Email Us : [email protected], and one of our Corporate tax specialists will provide you with necessary support and consultation.

FAQ

When can a Free Zone Person be a Qualifying Free Zone Person?

A Free Zone Person that is a Qualifying Free Zone Person can benefit from a preferential Corporate Tax rate of 0% on their “Qualifying Income” only. In order to be considered a Qualifying Free Zone Person, the Free Zone Person must:

- maintain adequate substance in the UAE;

- derive ‘Qualifying Income’;

- not have made an election to be subject to Corporate Tax at the standard rates; and

- comply with the transfer pricing requirements under the Corporate Tax Law.

The Minister may prescribe additional conditions that a Qualifying Free Zone Person must meet. If a Qualifying Free Zone Person fails to meet any of the conditions, or makes an election to be subject to the regular Corporate Tax regime, they will be subject to the standard rates of Corporate Tax from the beginning of the Tax Period where they failed to meet the conditions.

Related Topics

Guide to Registration and Deregistration of Corporate Tax in UAE

Who is exempt from UAE corporate tax?

Taxable Person as per Corporate Tax Law in UAE

Top Audit Firms in Dubai, UAE 2023

Significant CD, MD, and FTA Decisions related to Corporate Tax in UAE