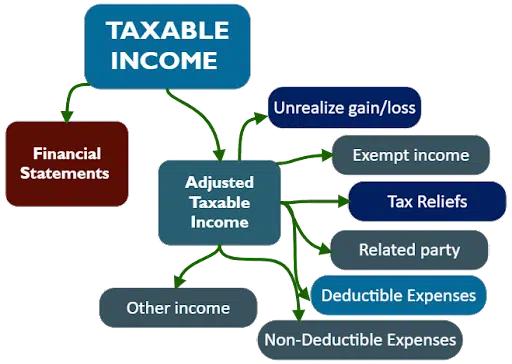

Taxable Income–(Article 20)

Taxable Income– Financial Statements (Article 20)

Taxable Person that prepares financial statements on an accrual basis may elect to take into account gains and losses on a realization basis in relation to:

- all assets and liabilities that are subject to fair value or impairment accounting under the applicable accounting standards; or

- all assets and liabilities held on capital account at the end of a Tax Period, whilst taking into account any unrealized gain or loss that arises in connection with assets and liabilities held on revenue account at the end of that period.

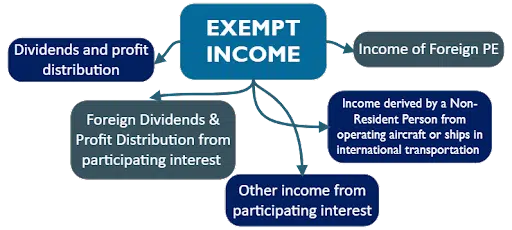

Exempt Income–(Article 22)

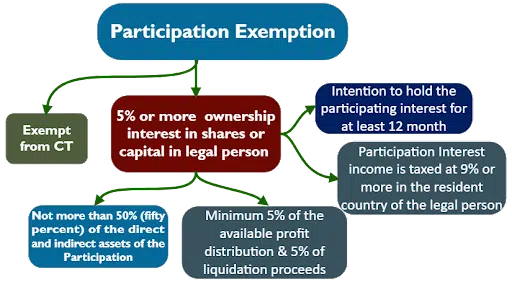

Participation Exemption – Conditions (Article 23)

- The principal objective of the Participation is the acquisition and holding of shares; and

- The income of the Participation derived during the relevant Tax Period substantially consists of income from Participating Interests.

Foreign PE Exemption – (Article 24)

- Taxable Person can make election to exclude the income and associated expenditure

of its foreign PE. - To calculate the income and associated expenditure of a Foreign Permanent

Establishment, a Resident Person and each of its Foreign Permanent Establishments

shall be treated as separate and independent Persons. - Transfer of Assets and liabilities between PE and Resident person must be treated at

market value on the date of transfer. - The exemption is not applicable to the taxable income of foreign Permanent

Establishment.

Non-Resident Person Operating Aircraft or Ships in International Transportation – (Article 25)

If non-resident person is performing the following business activities:

- International transport of passengers, livestock, mail, parcels, merchandise or goods by air or by sea.

- Leasing or chartering aircrafts or ships used in international transportation.

- Leasing of equipment which are integral to the seaworthiness of ships, or the airworthiness of aircrafts used in international transportation.

The exemption is only applicable if the non-resident person is also exempt for the corporate tax on similar business in the country of residence.

Contact us at @ +971 45 570 204 / Email Us : [email protected], and one of our Corporate tax specialists will provide you with necessary support and consultation.

Related Topics

Guide to Registration and Deregistration of Corporate Tax in UAE

Who is exempt from UAE corporate tax?

Taxable Person as per Corporate Tax Law in UAE

Top Audit Firms in Dubai, UAE 2023

Overview of Related Parties & Related Party Transaction Under Corporate Tax

Significant CD, MD, and FTA Decisions related to Corporate Tax in UAE