Economic Substance Regulations (ESR): The business environment in the United Arab Emirates has seen significant transformations as a result of the implementation of rules such as the Value-Added Tax (VAT) and Anti-Money Laundering Laws. Since the Economic Substance Regulations (ESR) Abu Dhabi were put into effect, there has been an increase in the demand for enforcement from companies in the United Arab Emirates.

The UAE has adopted the ESR in an effort to adhere to the OECD’s global norms in order to prevent fraudulent tax avoidance activities. The new law allows continental, free zone and offshore businesses in the UAE to show their economic content in their respective operations within the UAE. Both businesses are expected to apply the notification of economic substances to the regulatory authorities in the first step of ensuring compliance with the ESR Abu Dhabi within the specified time period.

On 30 April 2019, the UAE adopted and provided guidelines on economic substances (Cabinet of Ministers of Resolution No. 31 of 2019). The Rules became effective on 11 September 2019 (Ministerial Decision 215 of 2019). It includes all UAE territories, including the free financial regions. The laws and directives apply.

Economic Substance Regulations Abu Dhabi Filing

In order to obtain compliance with major regulators in Europe and the US, the Economic Substances Regulations (ESR) are implemented in countries worldwide. These regulations aim at jurisdictions to provide corporations with minimum tax obligation to show that they have appropriate economic content in that jurisdiction. They involve certain organisations carrying out a certain Economic Substance Regulations form of business activity.

The rules emphasise that all commercial activities conducted by legal entities of the United Arab Emirates, including corporations, branches and subsidiaries, and those situated in any free zone in the UAE are routinely registered, monitored and published. The free zones and offshore companies keeping a trade licence in the UAE must report regulatory whether the related operations in the UAE are carried out or not. Free region businesses are expected to send a Notice of the Economic Material to the free zone authorities involved, while continental firms are obliged to inform the Economics Minister if the related operations are carried out.

The timelines have been declared by the free region administrators and the Ministry of Economy to present the notification of Economic Substances at the UAE. Since the Notification of Economic Substance Regulations UAE is a compulsory necessity, credible ESR service firms are urged to consult in Dubai.

Economic Substance Regulations Abu Dhabi: Who Should File the Notification?

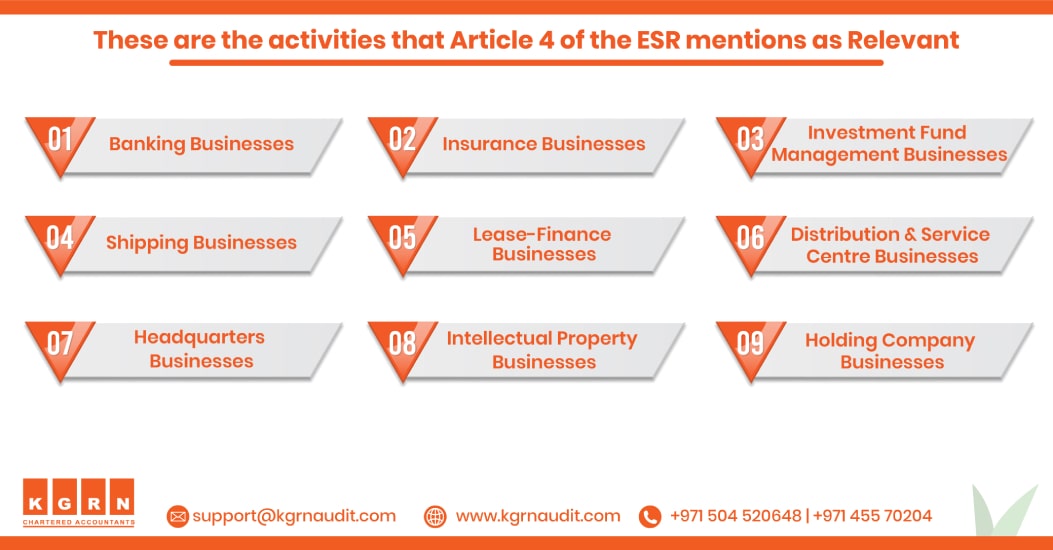

One or more licensees undertakings who produce appropriate and core income during the respective year shall apply to the Registration Authority a notification:

- The time period “banking businesses” refers to institutions that provide individuals and other organizations with a lot of economic offerings, along with deposits, loans, and chances to invest cash.

- Insurance Companies: Businesses that fall into this category provide a number of insurance guidelines, including fitness, life, property, and casualty insurance, to customers a good way to reduce their exposure to ability financial losses.

- Investment Fund Management Companies: These corporations take the money of their customers and invest it in loads of economic products such as stocks, bonds, and real estate. The clients pay the groups charges or commissions in alternate for the services they offer.

- Lease-Finance Businesses: These corporations provide clients loads of rent and financing alternatives for property inclusive of machinery, automobiles, or gadget. This offers customers the capability to apply assets without having to purchase them outright.

- Companies That Have Their Own Headquarters: These are the offices which can be often considered to be the core administrative workplaces of establishment businesses. These are the places of work which can be responsible for making strategic picks and coordinating worldwide operations.

- Companies that participate within the transportation of goods and load with the aid of quite a few ways, including ships, boats, and logistics services, are called delivery organizations.

- Businesses Classified as Holding Companies Holding groups are businesses whose primary characteristic is to own and manage the belongings and investments of other subsidiary companies, generally for the purposes of diversification and hazard control.

- Companies that address highbrow belongings are referred to as “intellectual assets businesses.” These businesses are worried inside the development, safety, licensing, and monetization of intellectual belongings property like patents, emblems, copyrights, and trade secrets and techniques.

- Businesses That Serve as Distribution and care Centres These sorts of groups act as hubs for the distribution of products or services, and they regularly offer customers and customers assist in the form of logistical help and client care.

How to File Annual Notification for Economic Substance Regulations in Abu Dhabi?

ESR Abu Dhabi regulations mandate mainland, free region and offshore firms to self-evaluate their operations and report to the appropriate regulatory authority on the notice for the Economic Substance Regulations UAE annually. Companies must prove this when filing the UAE notice of economic substances. The economic substance regulations form need to be filled.

- whether or not the operations in the UAE are carried out

- If the profits of the company are taxable outside the UAE

- Financial Workout Deadline

Economic substance regulations deadline in Abu Dhabi

It is important to complete the Economic Substance Regulations UAE notification before the deadline. Economic Material Notification for continental companies which carry on related activities in the UAE is governed by the Ministry of the Economy (MoE). According to the MoE Rules, businesses on the mainland shall file notifications on economic substances by 30 June 2020.

Who is exempt from filing an ESR Notification in Abu Dhabi?

The following organisations are currently deemed exempt under the revised ESR from the regime of economic substances:

- Funds for investment;

- Entities outside the UAE that are tax residents;

- entities which are wholly owned and are not part of a multinational group and are wholly owned by UAE citizens and I are involved in the UAE only;

- Foreign subsidiaries outside the UAE are subject to tax.

Entities of at least 51% UAE possession are removed from the regime formerly in respect of economic substances. This exception is no longer valid under the revised ESR.

Economic Substance Test Requirements in Abu Dhabi

A Licensee shall satisfy all the following requirements for fulfilling the test for economic substances (as specified below):

- It conducts in the UAE, as set out in the Regulations the related ‘central income generation practise’

- In relation to the operation, it is driven and controlled in the UAE

- It has a large number of trained full-time workers physically present in the UAE

- It entails ample running costs in the UAE

- It has ample physical assets for survival in the UAE

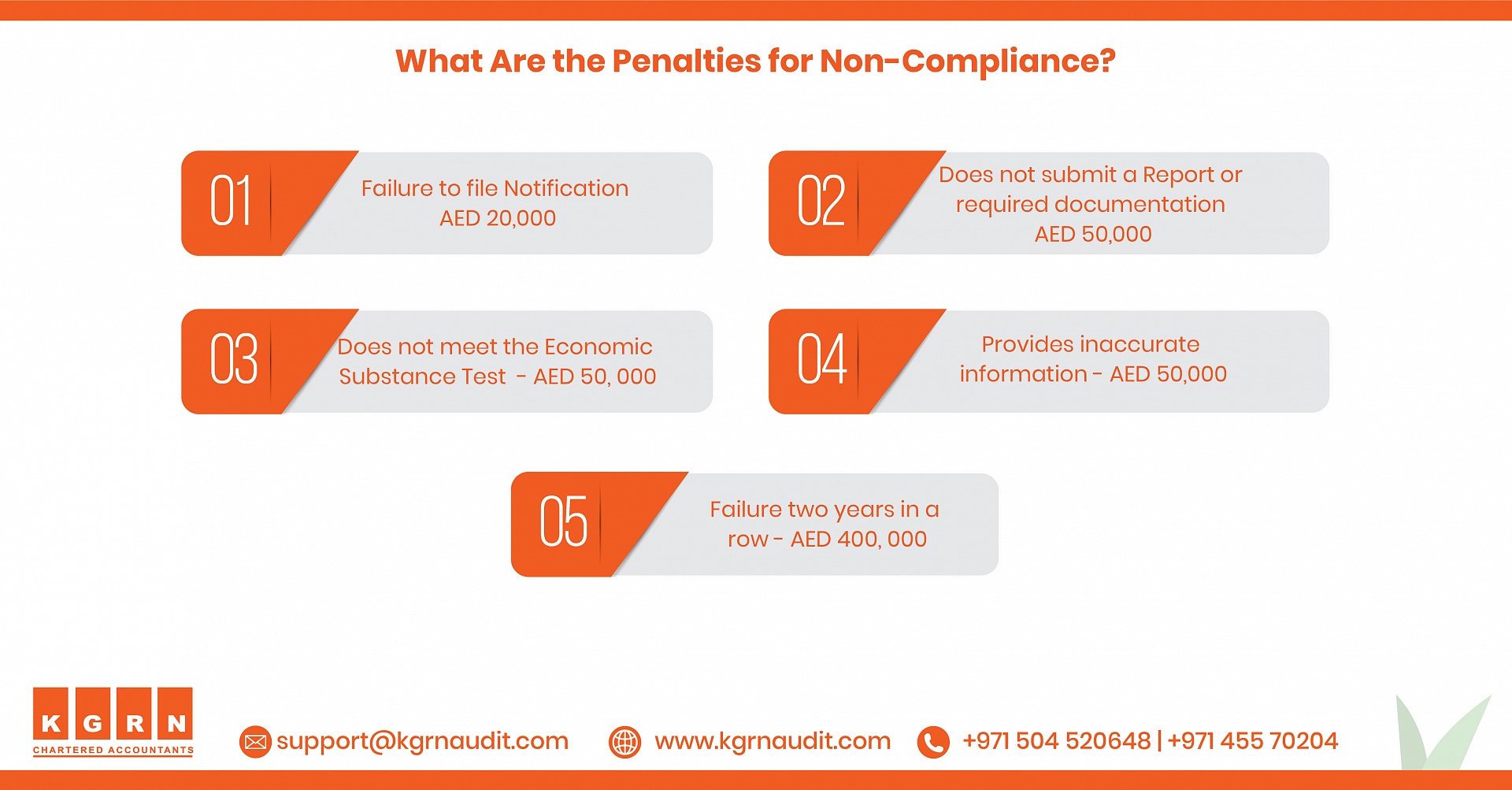

Penalties for Failing to File Economic Substance Notification in Abu Dhabi

The notification for financial substances must be filed prior to the specified date by the mainland, free zone and offshore firms. If the Government regulators are not contacted by the deadline for economic substance regulations UAE notification, heavy fines of AED 10.000 to AED 50,000 will be levied. For inaccurate information to be given in the notice, the businesses will be subject to the same fine. The businesses should contact Dubai’s finest ESR service firms, UAE, in order to prevent such unpredictable occurrences.

Here is a list of sanctions the corporations are responsible for paying under the Economic Substance –

UAE rules of procedure;

- Do not submit a Notification – AED 20,000

- No paper or documents – AED 50,000

- If the Economic Substance Test does not complete – AED 50,000

- Provides unreliable details – AED 50,000

- Second-year of loss – 400,000 AEDs and other measures

How can KGRN help?

One of the best UAE ESR services is provided by KGRN. KGRN will assist organizations in determining the eligibility of these guidelines and, if so, help them effectively comply with the default guidelines. KGRN experts help firms keep thorough records and file the necessary documentation for compliance.

ESR Services offered by KGRN in Abu Dhabi

The services offered by the KGRN regarding the ESR are:

- ESR guidelines advisory services

- Helps businesses to determine whether they are liable for the legislation on economic substances

- Identify which corporate segments comply with ESR

- ESR-ready monitoring and assistance with ease

- To promote and encourage compliance with the new Economic Substances Regulation

- ESR enforcement secretarial facilities and record management

- Control on economic substances filing in the correct format

For more questions & clarifications on Economic Substance Regulations UAE, Click here

Related Posts

Chartered accountant firms in Dubai

Accounting and bookkeeping services in Dubai

Economic substance regulation UAE

ADNOC ICV Certification Agencies

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae