Economic Substance Regulations JAFZA

The Economic Substance Regulations JAFZA UAE was introduced to help promote transparency and accountability within the economy. The implementation of the Economic substance Dubai helped in improving the efficiency of the UAE’s economic infrastructure. The Economic Substance Regulations UAE requires all Onshore, Mainland and Offshore companies to demonstrate they have enough economic presence within the UAE. The Economic Substance Regulation UAE norms also hold in areas such as the JAFZA. Here’s an in-depth look at the ESR guidelines in JAFZA and why they are so essential.

Economic Substance Regulations (ESR) in Jebel Ali Free Zone (JAFZA), UAE

The Economic Substance Regulations JAFZA mandates that all companies, whether Offshore or Free Zone licensed in the area, must abide by ESR laws. Hence, as a result, all eligible entities within the Jebel Ali Free Zone must maintain compliance with Economic Substance Dubai laws. As a result, ESR in JAFZA required all eligible companies to file an ESR notification before 30th June, 2020. Additionally, Economic Substance Regulations JAFZA requires all eligible companies that conduct relevant activities to perform the required economic substance test.

Economic Substance Regulations in JAFZA: Who Should File the Notification?

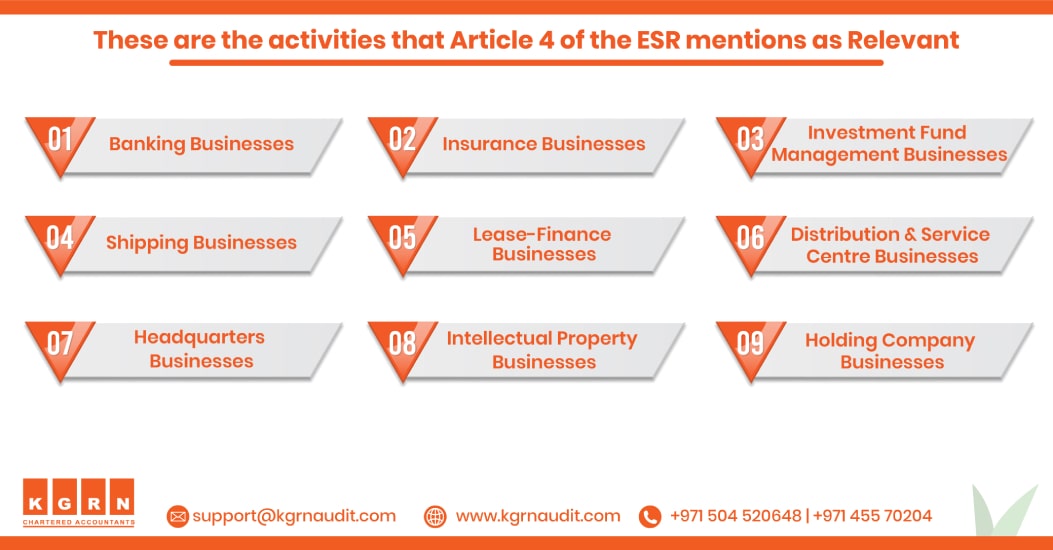

As per the ESR guidelines, all free zone, mainland and offshore companies that engage in relevant activities must file a JAFZA ESR form. This economic substance notification form helps in notifying the concerned authorities about the Relevant Activity pursued and the company’s main income-generating activities. Afterwards, the eligible companies must perform an economic substance test and file an extensive report demonstrating their economic presence within the UAE. The JAFZA ESR form must be filed to the JAFZA, which acts as the concerned authority in this case. All companies that engage in the following Relevant Activities will have to file an Economic Substance Notification form;

- Banking

- Insurance

- Investment Fund Management

- Lease-Finance

- Headquarters Business

- Shipping

- Holding Company Business

- Intellectual Property Business

- Distribution and Service Centre

How to File Annual Notification for Economic Substance Regulations JAFZA?

One of the most integral prerequisites for filing an Economic Substance Return in the UAE is to notify the concerned authority about an entity’s activities. Hence, all eligible companies under JAFZA’s authority must notify it regarding the core income-generating activities of the company. The JAFZA ESR form, therefore, serves as a prerequisite for filing the Economic Substance Return.

However, before filing the Economic Substance Notification form, companies must assess whether they are eligible for the ESR guidelines. In most cases, companies take the help of a professional ESR agency to ascertain their eligibility. If the agency finds that the company does engage in any relevant activity, it must notify the JAFZA via the appropriate ESR form.

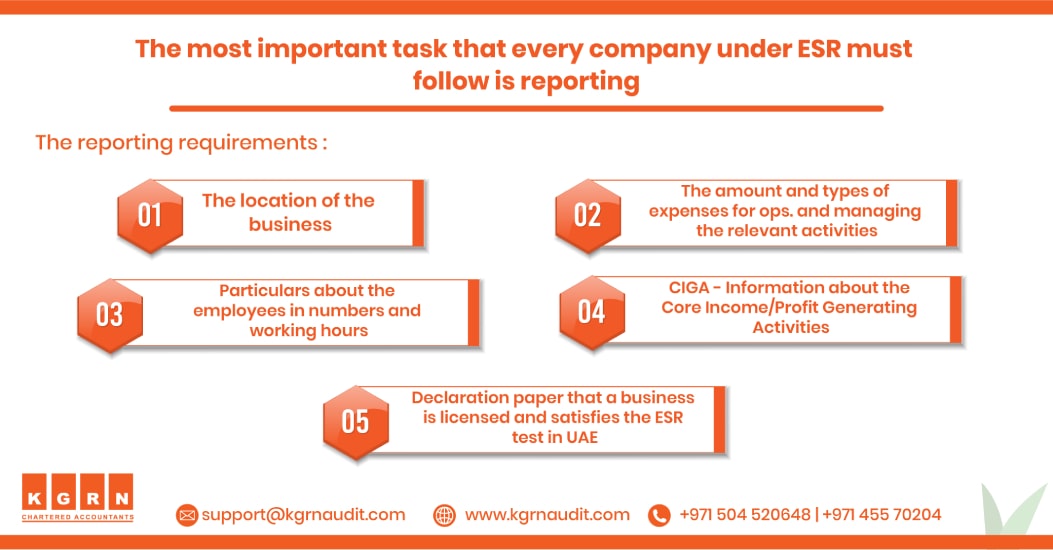

As per regulations, companies must adopt a substance over form approach while filing their JAFZA ESR notification. Hence, they will have to look beyond their mere trade license to ascertain whether any activity they undertake in qualifies as a relevant activity. Hence, all companies that fall within the scope of the ESR guidelines in JAFZA must disclose the following;

- Relevant activities conducted in the UAE

- Taxation of the income generated outside the UAE

- Financial year-end-date

In most cases, the best course of action would be to take the help of professional ESR services for the assessment and filing of the JAFZA ESR notification.

Economic Substance Test Requirements in JAFZA

One of the most fundamental components of adhering by ESR rules in JAFZA is to file the JAFZA ESR form. However, after doing so, the corporation has to follow up by establishing that they have an adequate economic presence in the UAE. The method via which enterprises in the area prove that they do have adequate economic presence or substance in the area is known as the Economic Substance Regulations Test. Economic Substance Test requirements in JAFZA requires them to demonstrate the following;

- The company directs and manages all the relevant activities in the UAE

- Core Income Generating Activities occur within the UAE

- Has enough employees, maintains adequate premises and expenditure in the UAE

Penalties for Failing to File Economic Substance Notification in JAFZA

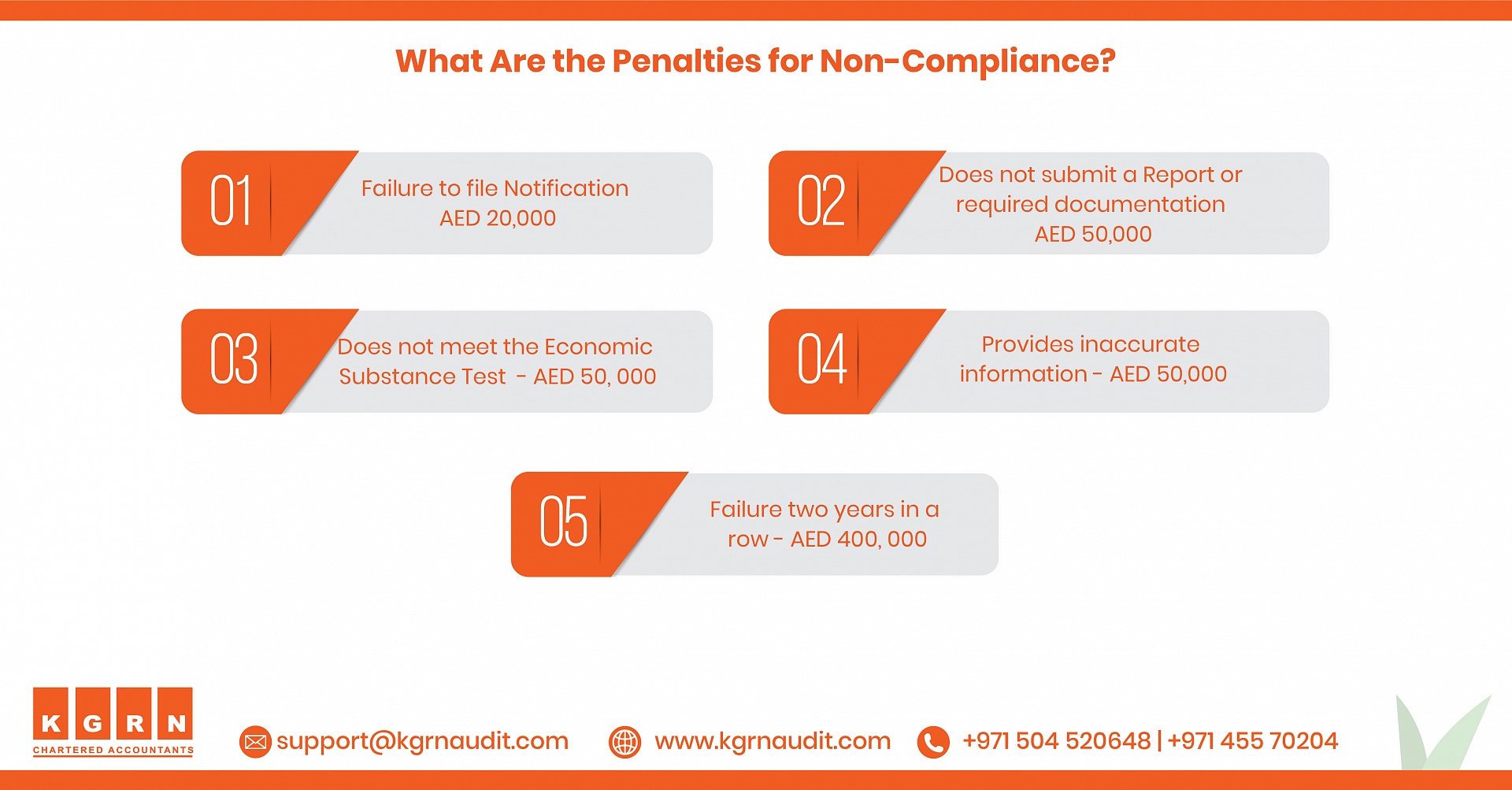

All companies that engage in a Relevant Activity and come under the scope of ESR activities must comply with its requirements. Failure to follow the guidelines established can lead to penalties and administrative actions of varying degrees. Any company that fails to submit the required Economic Substance Notification Form in UAE may attract a fine as high as AED 50,000.

The range of penalties or fines for such an offence varies between AED 10,000 to AED 50,000 depending on the severity of the offence. Hence, companies which are unsure about whether they qualify for the guidelines or not should seek professional help immediately to avoid such penalties.

Penalties on Incorrect Information in Economic Substance Notification in JAFZA

All businesses that file an Economic Substance Return must provide true and accurate information. Withholding information, as well as providing incomplete or false information, is a violation of the ESR JAFZA rules. A JAFZA business entity that submits incorrect information in its annual ESR notification will face a hefty fine or penalty.

The penalty it would have to pay would be between AED 10,000 and AED 50,000. Furthermore, if the regulatory authority discovers that an entity knowingly filed incomplete information, the company will be considered to have failed the ESR test. As a result, when submitting their Economic Substance Notification form to JAFZA, all companies should seek professional assistance.

How can KGRN help?

All eligible companies that engage in relevant activities must abide by the ESR guidelines in JAFZA. KGRN Chartered Accountants provides one of the best ESR services in UAE. Hence, we can help you if you are unsure about whether you are eligible for ESR guidelines.

Our team of legal experts and accountants can help identify whether you fall under the scope of the ESR guidelines and assess your core activities. We can also help you file your ESR notifications and returns for you, enabling you to stay compliant at all times. So, what are you waiting for? Leave all your ESR compliance woes behind with KGRN by your side!

For more information about ESR, Visit: Economic Substance Regulations UAE

Related Posts

ADNOC ICV Certification Agencies

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae