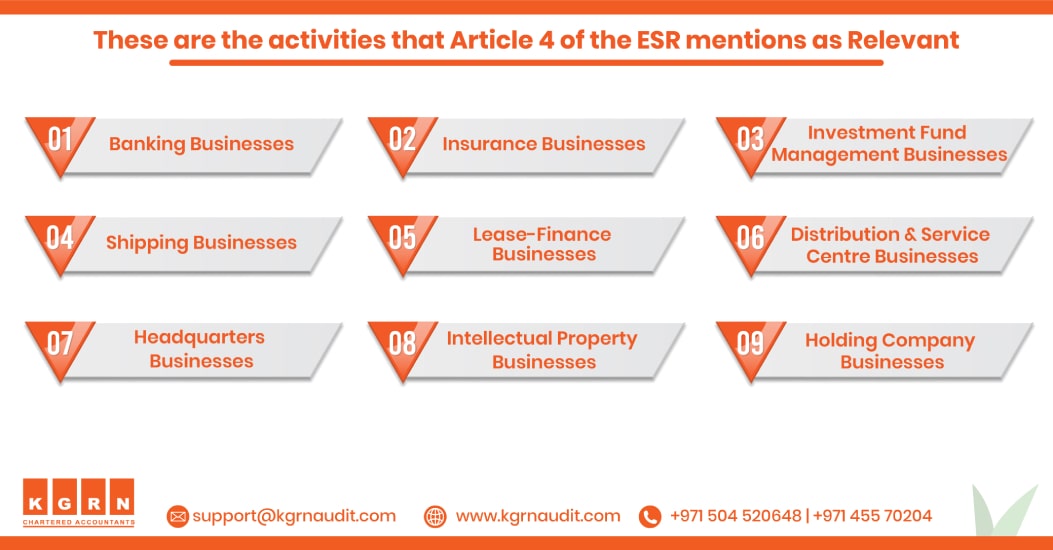

Do the Economic Substance Regulations UAE only apply to UAE entities that are part of a foreign multinational group or foreign shareholder?

Nope. The rules establish the requirements for economic substance regulations UAE for any UAE entity that carries out relevant activities, needless of whether the UAE entity is held by the foreign multinational group. However, a distribution business in the UAE, a service business centre, head office or a high-risk intellectual property business is subject to the Rules only if the company from the UAE makes transactions with foreign companies of the group. Distribution activities, service centre, head office and high-risk intellectual property, where transactions between entities of the UAE do not fall under the requirements of an economic entity.For enquiries, call +971 45 570 204 / E-mail: [email protected]

Is a company under a free zone (offshore) regime subject to the same Economic Substance Dubai rules?

Yes, if the “offshore” company carries out the relevant activities.

Based on the listed activities on the commercial license, should a Licensee undertake a Relevant Activity?

Who is exempt from the Regulations?

Licensees who are directly or indirectly at least 51% owned by the federal government or the government of the emirate, government body or body of the UAE.

When a licensee does not undertake relevant activities during the financial period, what happens?

If a licensee does not undertake a Relevant Activity during a financial period, it does not need to meet the Economic Substance Test. The Licensee, therefore, does not have to notify (see question 38) its Regulatory Authority or submit an Economic Substance Return (see question 39) for the relevant financial period.

What happens if there is no income on taking up relevant activities during a financial period by obtaining the license?

A licensee should notify its Regulatory Authority when the licensee does not earn any income from relevant activities done during the financial period while they are not required to meet the Economic Substance Test.

If a licensee obtains income only from the Relevant Activity is earned from outside the UAE, then is the licensee an exempt from regulations?

The licensee must produce the economic essence in the UAE that comprises all income from the UAE along with the income received outside the UAE and on producing the licensee is not exempt from the rules.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

The UAE recognises that enterprises vary in size and character, and what is adequate and appropriate will depend on the nature and level of operations performed, as well as the Licensee’s income. As a result, the laws and guidelines lack a minimum “adequate” or “appropriate” requirement. Regulators are expected to use a pragmatic approach in determining whether or not a Licensee has passed the economic substance test, recognising that the type and degree of activity of the Licensee may vary over the fiscal period and from year to year.

Can the Licensees who are part of the same group prefer to be evaluated on a “consolidated” basis or will the Economic substance regulations Dubai be evaluated on a Licensee-by-Licensee basis?

No. The rules do not allow the consolidation of licensees in one group for the purpose of an economic entity. Each Licensee will have to comply with the Rules and demonstrate the economic essence on an individual basis. At the same time, the corresponding economic substance (personnel, functions, assets, etc.), supported in the UAE by other companies of the group, can be taken into account if this economic substance is provided to the Licensee in accordance with the type of service/outsourcing agreement (see Question 21).

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Yes, Licensees must hold a sufficient number of board meetings in the UAE. The sufficient number of meetings of the board of directors depends on the nature and extent of the relevant activities carried out by the Licensee. For each board meeting held in the UAE:

- A quorum of directors must be physically present in the UAE.

- Furthermore, the management must save and sign the minutes of the meeting.

- Directors present at a meeting of the board of directors must have the necessary skills and experience to fulfil their fiduciary duties.

- Also, a holding’s business need not be directed or managed in the UAE unless required by the appropriate licensing authority.

Do employees who perform the CIGAs need to be resident in UAE?

The licensee performing CIGAs must be a resident of the UAE. The employees or other persons who are not a resident of the UAE should process the UAE economic substance regulations only when

(i) appropriate actions are performed when an individual is present in the UAE, and under the guidance of the Licensee and (ii) the Licensee bears the relevant expenses of the individual who is not a resident of the UAE.

Do the directors of the Licensee need to be resident in the UAE?

No, directors only need to be physically present in the UAE to participate in relevant meetings of the Licensee’s council.

Are Directors employees?

Yes, directors who, in addition to fulfilling their fiduciary duties, also perform CIGA. Hence, they can be considered employees of the Licensee for the purpose of testing the Economic Substance Regulations UAE,

For enquiries, call +971 45 570 204 / E-mail: [email protected]

No, obtaining a UAE tax residency certificate requires a certain minimum presence in the UAE. The UAE tax residency certificate does not in itself prove that the Licensee has sufficient economic content in the UAE in relation to the related activities and income received from these activities.

What can a Licensee outsource?

A Licensee can outsource any or all of its CIGAs so long as the outsourced activities occur in the UAE. Effectively, this means that a Licensee can use UAE based (i) employees and (ii) physical assets. Also, this includes the premises of the third parties or related entities to fulfil the satisfaction of the Economic Substance Test. Moreover, the Licensee is unable to outsource the “directed and managed”. Hence, the Licensee must demonstrate supervision and control over the relevant activities in the UAE.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

A Licensee can outsource, contract or delegate CIGAs to related parties or to third-party service providers. However, the Licensee must monitor and retain the ability to control outsourced activities.

What should a Licensee do under an outsourcing arrangement?

A Licensee should:

- Possess enough supervision of the outsourced activity; and

- Ensure the outsourced activity occurs in the UAE; and

- Ensure the outsourcing provider has adequate substance in the UAE; and

- Ensure there is no double-counting of the outsourcing providers resources. To ensure this, the licensee must utilise contractual agreements that govern the relationship and responsibilities of each party.

Can a Licensee outsource any of its activities to a foreign person?

Yes, related parties and third-party service providers outside the UAE can perform activities that are not CIGAs (e.g. back-office functions). Hence, such outsourcing does not adversely impact the economic substance of the Licensee in the UAE.For enquiries, call +971 45 570 204 / E-mail: [email protected]However, the New ESR (Economic Substance Regulations Dubai) have overhauled the roles and responsibilities by introducing the Federal Tax Authority (FTA). Introduced as the National Assessing Authority (NAA) and made some changes in the definitions of some relevant activities.For Enquiries Contact KGRN Team

Managing Partner – Gopu Rama Naidu

E-mail: [email protected]. Ph: +971 455 70204

Related Post:

- Things To Know About UAE Economic Substance Regulations

- Economic Substance Regulations(ESR) in UAE – Extended Deadlines For Notifications

Our Services

- Audit firms in Dubai

- Audit services in Dubai

- Accounting services in Dubai

- Accounting and Bookkeeping services in Dubai

- ICV certificate

- ADNOC ICV Certification Agencies

- Internal Audit Firms in Dubai

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae