The Economic substance Regulation is a percept in the UAE’s tax framework. The UAE government introduced it on January 1st, 2019. The Economic Substance Regulation applies to all businesses in the UAE, including free zone companies, partnership firms, onshore companies, and non-partnership firms. According to the framework, every licensee must comply with the Economic Substance Regulations in UAE.

The primary purpose of the Economic Substance Regulations is to ensure that the licensee’s recorded profits are in accordance with the entirety of economic activities in the UAE.

What is the Economic Substance Notification Form?

The Economic Substance Notification form will help the government and concerned authorities in analyzing the entire business scene in the UAE.

Article 4 governs the regulations of the Economic Substance Regulations in UAE. According to it, the companies falling under the following sectors have to submit an Economic Substance Notification form in UAE:

- Banking and Insurance

- Investment and fund management

- Lease, finance businesses

- Headquarter Businesses

- Shipping businesses

- Holding company business

- Intellectual property management

- Distribution and service centre business

All businesses operating in the UAE must file economic substance regulations form other than the dissolved businesses, liquidated entities, and struck-off companies.

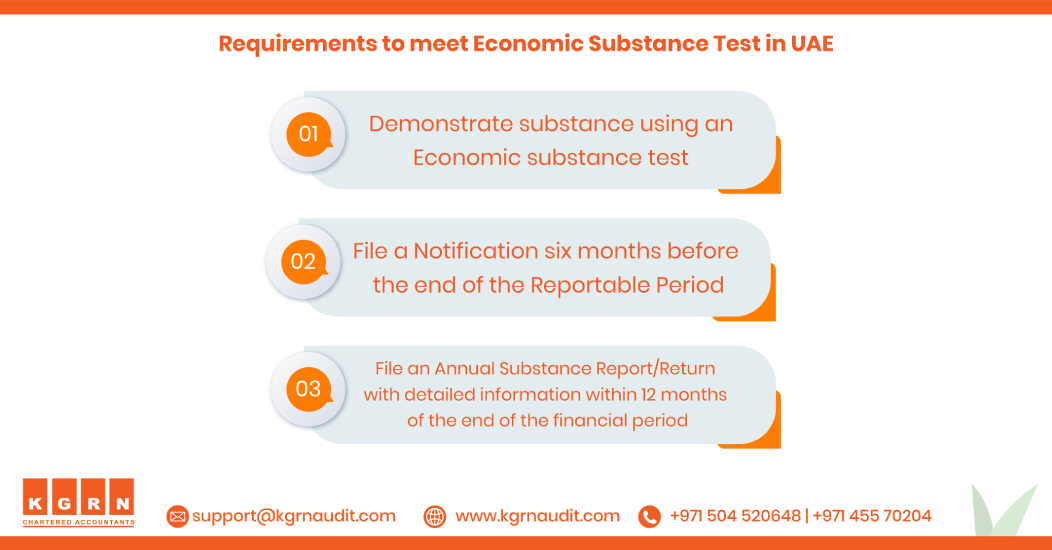

Economic Substance Test:

The economic substance test requires a license holder to demonstrate or elaborate on the following:

- The way of direction and management of the company and the Relevant Activity in the UAE

- The amount of income the relevant Core Income Generating Activities culminate

- The number of employees employed in the licensee’s company in the UAE.

- Details on the physical assets and expenditure of the licensee in the UAE.

Economic Substance Regulations in UAE:

- The licensees under Economic substance regulation must have a high degree of control over developing their company’s IP assets.

- He/she must adequate full-time employees with the required qualifications who permanently reside and perform their activities in the UAE.

- You will have to provide the necessary and relevant employee information like experience, contact details, qualifications, etc…

- The licensee must have a business plan showcasing the reasons for holding the IP in the UAE.

- Relevant decision making must continue to take place in the UAE.

- The company must have adequate expenditure incurred in UAE or adequate expenditure on outsourcing.

- The company must have adequate physical assets in the UAE.

- The Economic Substance Regulation permits third-party service providers, provided that the company has sufficient control and supervision.

- The Economic Substance Regulations notifications form has to be submitted within the financial year, irrespective of the company’s annual turnover and accumulated profits.

- Businesses that have several branches within the UAE can file a single ESR notification form for all its branches.

- However, the companies that have branches offshore or in many other countries must file a standalone notification form for each of its branches.

- Article 4 of the Economic substance regulations form states that the provisions of the ESR law do not apply to companies or businesses in which the Emirati Government or the Federal government has any direct or indirect ownership of over 51% share.

Why KGRN?

In the UAE, KGRN is a well-known legal firm. We have a team of skilled and qualified lawyers in the UAE who can assist businesses and individuals with their legal requirements. We help firms file ESR notification forms and reports, provide ESR testing, and answer related queries.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

For more Detailed information about ESR, Visit: Economic Substance Dubai Guidelines

or Contact our professionals for more details and assistance.

Related Posts

Chartered accountant firms in Dubai

Accounting and bookkeeping services in Dubai

Economic substance regulation UAE

ADNOC ICV Certification Agencies

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae