The United Arab Emirates is a member of the OECD Inclusive Framework. The plan to introduce the Economic Substance Regulations came after the UAE landed on the EU’s tax blacklist. The implementation of the ESR Notification UAE helped the country improve its credibility and get off the blacklist. The ESR form UAE is a part of the ESR UAE guidelines which came into being in April 2019. These laws came into force in January of the same year and helped strengthen the nation’s position within the international market. Let us now take a closer look at ESR filing in UAE, and why it is essential.

What are the ESR filing guidelines?

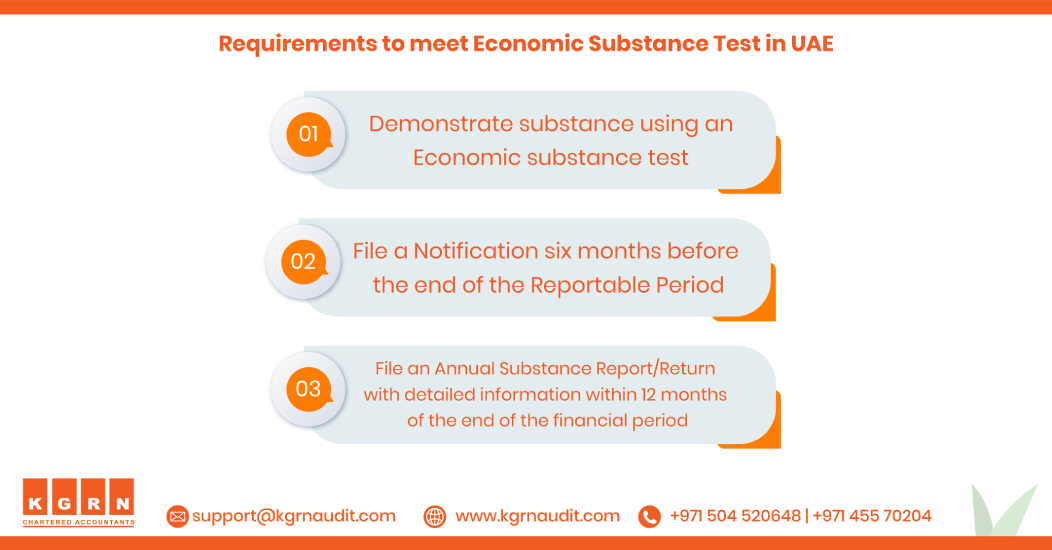

The ESR UAE guidelines helped the country by improving the security and accountability of its taxation system. The Economic Substance Regulations introduced two new filing requirements, which are given below;

- Economic Substance Regulations or ESR Notification UAE

- Annual Substance Return

All entities within the UAE that engage in Relevant Activities must file these two reports on time to stay compliant. The annual notification form ascertains that the entity falls under the purview of the ESR UAE guidelines. The secondary substance return details how the entity has been working towards maintaining the required economic substance within the country. This Substance Report must be filed at least twelve months before the end of the upcoming financial year.

Why KGRN?

Clearly, obtaining an ESR registration is a necessary step in the process of conducting business in the United Arab Emirates. Due to the fact that failing to comply with the aforementioned requirements might result in penalties and other legal issues, businesses are required to seek the advice of professionals in order to guarantee compliance. You will receive assistance from KGRN Chartered Accountants in comprehending the Economic Substance criteria of the United Arab Emirates. Furthermore, our staff will verify that your returns are filed on time and remedy any errors that may have occurred in your internal controls when they are discovered. Partner with us at KGRN’s ESR filing Services to ensure that your business continues to proceed in the right direction.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

For more Detailed information about ESR, Visit: Economic Substance Dubai Guidelines

Related Posts

Economic substance regulation UAE

Chartered accountant firms in UAE

ADNOC ICV Certification Agencies

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae