The UAE is a member of the OECD Inclusive Framework. As a result, the EU assessed the UAE’s tax framework, through the European Union (“EU”) Code of Conduct Group on Business Taxation. Therefore, to obtain a better rating, and improve operations, the UAE introduced a Resolution on the Economic Substance by implementing Economic Substance Regulations in UAE. Hence, the ESR regulations UAE guidelines came into force via Cabinet of Ministers Resolution No.31 of 2019, the “Regulations” on 30 April 2019.

The guidance that provides further clarity on the application of the Regulations -ESR was issued on 11 September 2019. Also, the Regulations require UAE onshore and free zone companies and other UAE business forms that carry out any of the “Relevant Activities” listed below to maintain an adequate “economic presence” in the UAE relative to the activities they undertake.

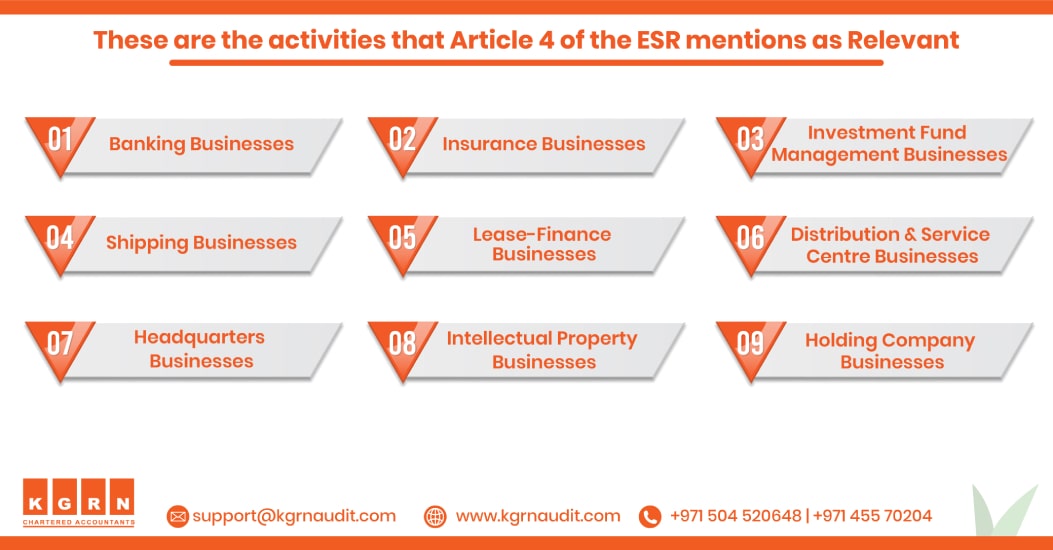

RELEVANT ACTIVITIES:

- Banking Business

- Insurance Business

- Investment Fund management Business

- Lease – Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual property Business (“IP”)

- Distribution and Service Centre Business

Why has the UAE introduced Economic Substance Regulations?

The UAE introduced Economic Substance Rules in UAE to honour the UAE’s commitment as a member of the OECD Inclusive Framework on BEPS. Furthermore, it was in response to a review of the UAE tax framework by the EU. As a result, UAE was a part of the EU’s list of non-cooperative jurisdictions for tax purposes (EU Blacklist).

The release of the Economic Material Regulations (the Regulations) on the 30th of April 2019 and the following publication of the guideline on the 11th of September 2019 requires that the UAE be removed from the EU Blacklist by 10 October 2019. The Regulations’ goal is to ensure that UAE firms that engage in specified activities (see issue 4) are not utilised to artificially attract earnings that are not commensurate with the UAE’s economic activity.

The Regulations apply to financial years starting on or after 1 January 2019. Example

1: A UAE company with 1 January 2019 – 31 December 2019 financial year: First assessable period would be 1 January 2019 – 31 December 2019. Example

2: A UAE company with 1 April 2019 – 31 March 2020 financial year: First assessable period would be 1 April 2019 – 31 March 2020. No need to comply with the Regulations for the period 1 January 2019 – 31 March 2019.

Who are the “Regulatory Authorities”?

Who is subject to the Economic Substance Regulations Dubai?

The economic substance rules in UAE apply to the following UAE companies that carry out any of the Relevant Activities;

- Onshore

- free zone companies

- Branches

- Partnerships

- Licensees

What is called as the economic substance test (ESR test)?

The economic substance test, which is also called as the ESR test, requires a Licensee to demonstrate that the relevant activity and the Licensee are being handled and managed in the UAE.

Moreover, the ESR test is to validate the relevant Core Income Generating Activities which the UAE conducts. The economic substance test helps the Licensee to have an adequate number of employees and takes care of adequate physical assets and expenditure in the UAE.

How KGRN Chartered Accountants Can help?

First and foremost, KGRN Chartered Accountants can assist you in gaining a comprehensive understanding of the UAE’s new economic substance legislation. Furthermore, KGRN Chartered Accountants may do an impact analysis, which involves examining and analysing the effect of the new economic substance regulations (ESR) on your existing operations in the UAE. Additionally, our experts may assist you in correcting problems to ensure perfect compliance. In addition, our team’s years of experience allow them to manage your documents swiftly and effectively.

As a result, we can identify gaps in the level of economic substance in affected entities and consider remediation options where gaps are identified. Hence, KGRN Chartered Accountants can assist in relevant compliances under the new regulations.

Contact KGRN Team for Enquiries:

Managing Partner – Gopu Rama Naidu FCA, CPA, ACCA

More Info about ESR in UAE

- Guide For UAE Economic Substance Regulations

- What is All About Economic Substance Regulations In UAE

- Economic Substance Regulations(ESR) in UAE – Extended Deadlines For Notifications

Our Services

- Audit services in Dubai

- Accounting firms in Dubai

- Bookkeeping services Dubai

- ICV certificate

- ADNOC ICV Certification Agencies

- Internal Audit Firms in Dubai

- ESR UAE