A notion that was included in the revenue framework of the United Arab Emirates (UAE) and went into effect on January 1, 2019, is known as economic substance regulations. The Environmental, Social, and Governance (ESG) framework applies to all in the United Arab Emirates (UAE), including onshore, free zone, non-partnership, and partnership firms. The ESR notification form was introduced in the United Arab Emirates for the primary purpose of supplying the Financial authorities with all of the information that pertains to the revenues of your company. In addition to this, it will be of assistance to the authorities in charge of the FTA in assessing the entire business scene and the economic development of the UAE.

The Amended Economic substance regulation appoints the FTA authorities as National Assessing Authority for ESR. It will further determine whether an entity meets the Economic Substance Test and issues penalties for breaches of the ESR regulations in the UAE.

Read on to find out more about the ESR UAE.

Article 4 of the Economic Substance Regulation:

Article 4 governs the regulations of the Economic Substance Regulations in UAE. According to Article 4, the companies falling under the following sectors have to file an ESR notification UAE:

- Banking and Insurance

- Investment and fund management

- Lease, finance businesses

- Headquarter Businesses

- Shipping businesses

- Holding company business

- Intellectual property management

ESR regulations UAE:

Here are a few key points that come under the ESR Regulations UAE.

- The licensees under the Economic substance regulation must have a high degree of control over their company’s IP assets.

- He/she must have adequate full-time employees in each branch with the required qualifications who permanently reside and perform their activities in the UAE.

- You will have to provide the necessary employee information like experience, contact details, and qualifications to the FTA.

- The licensee must have a business plan showcasing the reasons for holding the license for ESR in the UAE.

- Relevant decision making of the organization or company must continue to take place in the UAE.

- The company must have adequate expenditure accumulated in the UAE or adequate expenditure on outsourcing.

- The company or organization must have adequate physical assets in the UAE.

ESR notifications form:

You can file your organization’s economic substance notification form through the official portal of the Ministry of Finance. Your notification form must have the following information before submission:

- Details of the licensee

- Registered office address

- Branch details

- Details on your reportable period

- Type of relevant activity your business carries out

- Details on your profits

- Details on your eligibility for exemption

- The details of the parent company

- Details of the ultimate beneficial owner

- Details of the designated contact person

- Final declaration

ESR UAE Deadline, and penalties:

Every licensee is required to file their ESR notification form in UAE within 12 months from the end of your financial year.

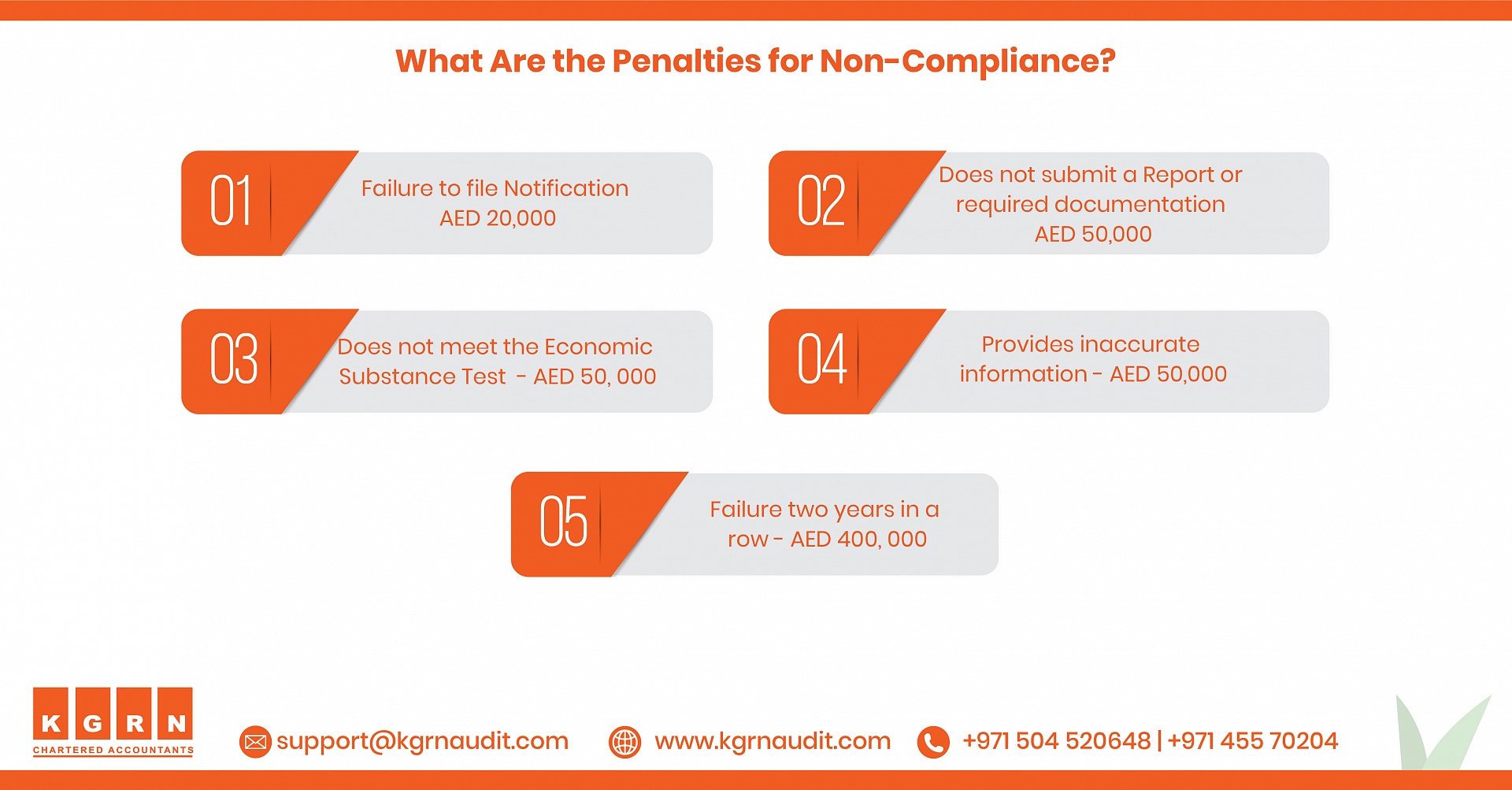

The following are the penalties for non-compliance with the ESR regulations:

- The penalty for failure to file the ESR form is AED 20,000.

- Penalty for failure to submit the ESR report is AED 50,000.

- The penalty for failure to take an ESR test within a financial year is AED 50,000.

- The penalty for providing inaccurate information is AED 50,000.

Why KGRN?

KGRN is one of the renowned legal service providers in the UAE. We have a team of knowledgeable and well-experience professionals who are always ready to assist you and clear your queries round the clock.

We assist companies in ESR UAE registration, filing their ESR notifications form, and fulfilling their obligations under the Economic Substance Regulations requirements.

For more Detailed information about ESR, Visit: Economic Substance Regulations(ESR) Guidelines

Contact our professionals for more information on our services and other ESR-related queries.

Related Posts

Chartered accountant firms in Dubai

Bookkeeping and accounting firms in Dubai

Economic substance regulation UAE

ADNOC ICV Certification Agencies

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae