The ESR UAE came into force in 2019 as a means to strengthen the nation’s taxation system. By adding this additional legal requirement, the UAE was able to get off the EU’s tax Blacklist and improve its credibility within international markets. The ESR in Dubai led to the addition of two filing requirements, which are as follows;

- ESR notification form

- Annual Substance Report

ESR in Dubai

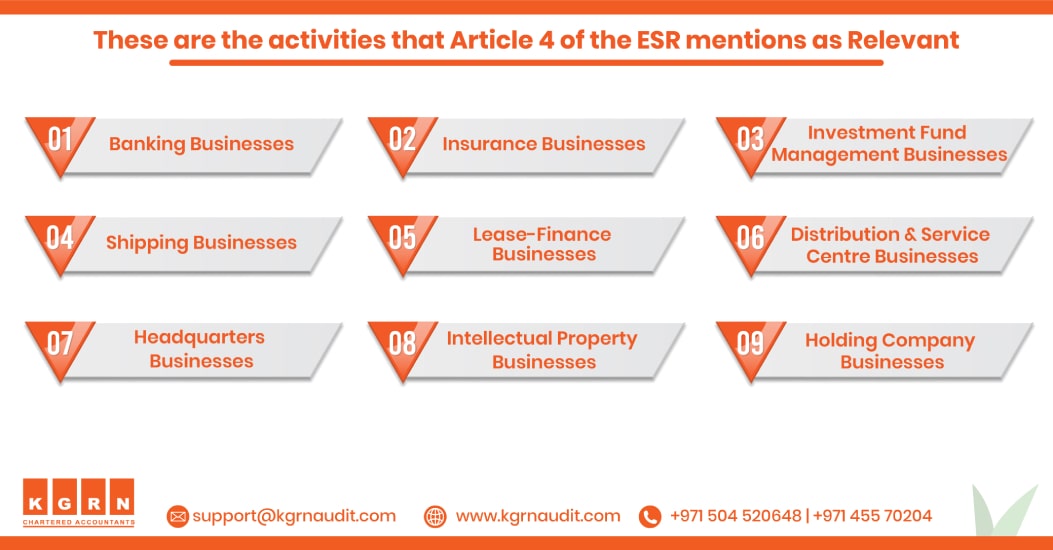

The ESR form UAE must be filed by all entities that engage in Relevant Activities within the UAE. All such companies must first perform an Economic Substance Test. This test will be able to verify and report details regarding the relevant activity performed and the extent of operations. Concerned entities must then also submit an annual substance report that indicates their economic presence in the UAE and proves that it is adequate.

Need for ESR Form UAE

The Economic Substance Regulations help countries which do not impose any corporate tax to comply with international guidelines on taxation. In addition to assisting in the prevention of tax evasion and avoidance, it also helps to build the physical infrastructure of a nation’s tax system. The Regulations, in essence, make it obligatory for businesses to provide evidence that they participate in the various economic activities that are required inside the United Arab Emirates. Companies operating in the United Arab Emirates are required to comply with both onshore and free zone laws.

The UAE Economic Substance Regulations went into effect in April 2019, and additional guidelines were issued in September of the same year. After consultation with the EU and the OECD, amendments to the predetermined legislation were made in August 2020. As you can see, keeping up with new amendments and changes may be difficult. However, rest assured because KGRN is here for you. We offer one of the best ESR services in UAE and can create tailor-made solutions as per your needs. So, partner with us and never worry about ESR compliance again!

For more Detailed information about ESR, Visit: Economic Substance Regulations(ESR) Guidelines

For enquiries, call +971 45 570 204 / E-mail: [email protected]