The Economic Substance Regulations UAE reporting came into force to improve the UAE’s taxation regime. As per the requirements of the Economic Substance Dubai, all eligible companies must submit an ESR notification form and annual substance report. All entities engaging in Relevant Activities will come under the purview of the Economic Substance Regulations UAE. Let us now take a look at the Economic Substance Regulations notification form and how the reporting works.

Economic Substance Regulations UAE Reporting

The ESR guidelines apply to all Onshore and Free Zone companies that carry out any of the following activities;

- Banking

- Insurance

- Investment fund management

- Lease-finance

- Headquarter businesses

- Shipping

- Holding companies

- Intellectual property

- Distribution and service centre

What are the filing requirements under the Regulations?

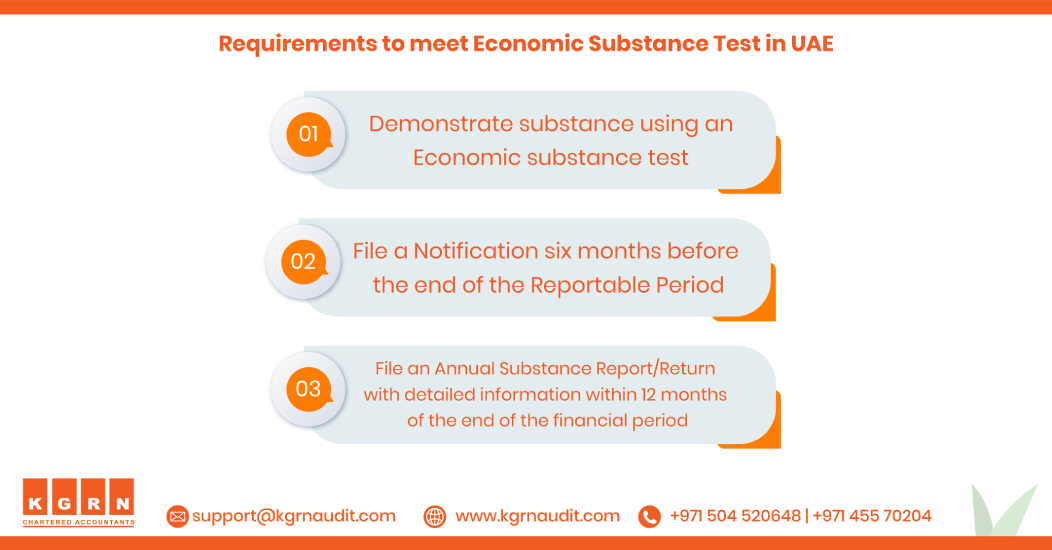

To determine their substance, all eligible entities must conduct an Economic Substance test in each fiscal period. A licensee must demonstrate the following through this test:

- The business operates and functions within the UAE

- All the relevant Core Income Generating Activities occurs in the UAE

- The business employs adequate workers and has the appropriate premises and expenditure

After performing such a test and filing the Notification form, such licensees must submit an economic substance return. Such a return must be submitted at least 12 months after the end of the financial period. The financial year for reporting starts from January 1, 2019, and the declarations for the same must be submitted before December 31, 2020. Also, these guidelines apply to all companies, even foreign multinational corporations.

What should companies do?

- All companies must assess if they fall into any of the given categories regarding Relevant Activities.

- Next, they must calculate the income generated through any such activity.

- Companies must hold board meetings with the required quorum of directors present.

- They should also perform an Economic Test to gauge their substance and report it.

- Finally, eligible companies ensure they comply with the ESR filing requirements.

For more Detailed information about ESR, Visit: Economic Substance Regulations(ESR) Guidelines

Related Information

Economic Substance Regulations

Related Posts

Chartered accountant firms in Dubai

Economic substance regulation UAE

ADNOC ICV Certification Agencies

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae