“As part of the UAE’s commitment as a member of the OECD Inclusive Framework, and in response to an assessment of the UAE’s tax framework by the European Union Code of Conduct Group on Business Taxation, the UAE issued Economic Substance Regulations (Cabinet of Ministers Resolution No. 31 of 2019), (the “Regulations”) on 30 April 2019. Guidance on the application of the Regulations was issued on 11 September 2019 (Ministerial Decision No. 215 of 2019), and Cabinet Decision No. 58/2019 on the Determination of Regulatory Competencies lists the Regulatory Authorities tasked with the administration and enforcement of the Regulations. Let’s see about the economic substance notification form.

Cabinet of Ministers Resolution No. (57) of 2020 amended the Regulations on August 10, 2020, and new Guidance was issued on August 19, 2020 (Ministerial Decision No. (100) of 2020). The Regulations require UAE onshore and free zone companies, as well as certain other business forms, that engage in any of the defined “Relevant Activities” listed below to maintain and demonstrate an adequate “economic presence” in the UAE in relation to the activities they engage in (“Economic Substance Test”).

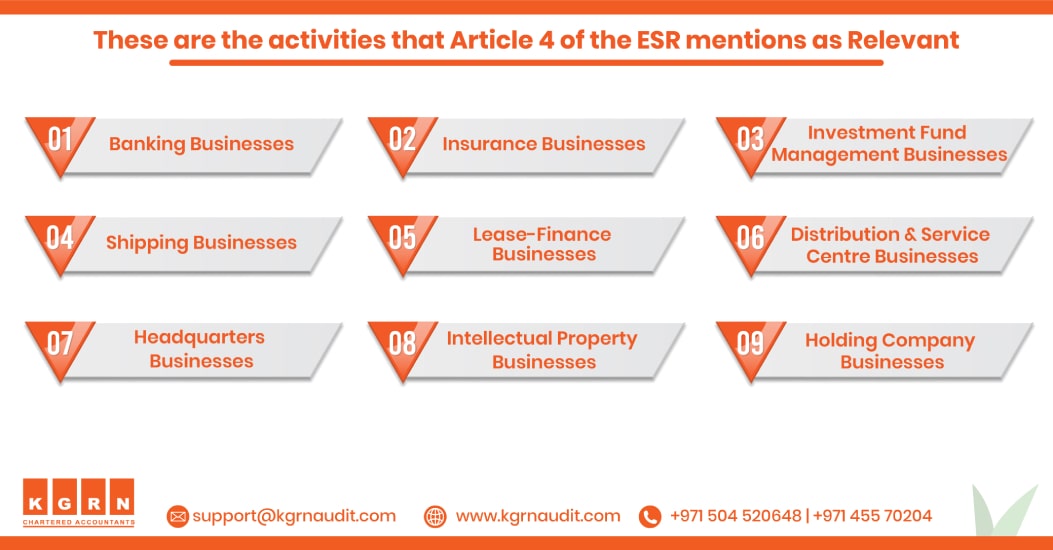

The Relevant Activities of Economic Substance Regulations UAE reporting are as follows:

- Banking Business

- Insurance Business

- Investment Fund management Business

- Lease – Finance Business

- Headquarters Business

- Shipping Business

- Holding Company Business

- Intellectual property Business (“IP”)

- Distribution and Service Centre Business

An entity is not needed to meet the Economic Substance Test and Filing an Economic Substance Report for any financial period in which it has not earned income from a Relevant Activity or if it meets the conditions for being exempt. A Notification form will need to be submitted surely. Failure to follow with the Regulations can result in penalties, spontaneous exchange of information with the Foreign Competent Authority (as defined in Article 1 of the Regulations), as well as other administrative sanctions such as the suspension, revocation or non-renewal of the entity’s trade license or permit.

For more Detailed information about ESR, Visit: Economic Substance Dubai Guidelines

Related Information

Related Posts

Bookkeeping and accounting firms in Dubai

Economic substance regulation UAE

ADNOC ICV Certification Agencies

For enquiries and to know about Economic Substance Regulations notification form, call +971 45 570 204 / E-mail: [email protected]

Tag: esr filing requirements, esr filing abu dhabi, esr filing company dubai, esr filing company in uae, esr notification filing deadline, uae esr filing, esr submission guidelines, esr filing in dubai, esr filing company in dubai, esr return filing uae