Value Added Tax or VAT is a tax on the consumption or use of goods and services charged at every point of transaction. The Vat consultancy services in Dubai is a method of indirect tax and is charged in more than 180 countries everywhere in the world. The end-consumer finally accepts the cost. Businesses pull together and account for the tax on behalf of the government.

Norms for registering for VAT

- A business must register for vat firms in Dubai, UAE if its taxable provisions and imports go beyond AED 375,000 per annum.

- It is elective for businesses whose supplies and imports go beyond AED 187,500 per annum.

- A business household pays the government, the tax that it saves from its customers. At the same time, it collects a refund from the government on tax that it has waged to its suppliers.

- Foreign businesses may also make progress in the VAT they acquire when visiting the UAE.

Who should register under VAT?

Under VAT, do all businesses have to sign up? No, only companies that make more than a certain amount of money in a year as a whole are required to register for VAT. Depending on the threshold for registration, a company will either have to register or can apply to register or ask to be exempt from VAT registration.

Based on this, you could split VAT registration in UAE into the following:

- Mandatory VAT Registration

- Voluntary VAT Registration

- Exemption from VAT Registration

Register VAT Firms in Dubai

Businesses can register for vat firms in Dubai, UAE over the eServices section on the FTA website. However, they want to create an account first.

VAT collected process

- VAT-registered businesses collect the expanse on behalf of the government; customers accept the VAT in the form of a 5 percent increase in the cost of taxable goods and services they buying in the UAE.

- UAE executes VAT on tax-registered businesses at a rate of 5 percent on a taxable amount of goods or services at each stage of the supply chain.

- Visitors in the UAE also pay VAT at the point of sale.

On which businesses does VAT apply?

VAT applies Similarly on tax-registered businesses accomplished on the UAE mainland and in the free zones. However, if the UAE Cabinet describes a certain free zone as a ‘designated zone’, it must be preserved as outside the UAE for tax purposes. The transfer of goods between selected zones is tax-free.

Filing a return for VAT

- At the close of each tax period, vat firms in Dubai registered businesses or the ‘taxable persons’ duty to submit a ‘VAT return’ to Federal Tax Authority (FTA).

- A VAT return sum up the value of the supplies and purchases a taxable person has completed during the tax period and shows the taxable person’s VAT liability.

Liability of VAT

The liability of vat firms in Dubai is the difference between the production tax, for a given tax period and the contribution tax recoverable for the same tax period.

Where the output tax goes beyond the contribution tax amount, the difference must be funded to FTA. Where the contribution tax go beyond the production tax, a taxable person will have the extra contribution tax recovered; he will be permitted to set this off against the following payment due to FTA.

VAT file return

You must file for a tax return by e-mail through the FTA portal: eservices.tax.gov.ae. Before filing the VAT return form on the portal, make assured you have encountered all tax returns requirements.

When are businesses mandatory to file VAT returns?

Taxable businesses must file VAT returns with FTA on a steady basis and frequently within 28 days of the end of the ‘tax period’ as definite for each type of business. A ‘tax period’ is an exact period of time for which the payable tax shall be calculated and paid. The standard tax consultancy in the Dubai period is:

- Quarterly for businesses with an annual turnover under AED 150 million.

- Monthly for businesses with an annual turnover of AED 150 million or more.

- The FTA might, at its discretion, assign a different tax period for certain types of businesses.

- Failure to file a tax return within the specified time frame will make the violator liable for fines as per the requirements of Cabinet Resolution.

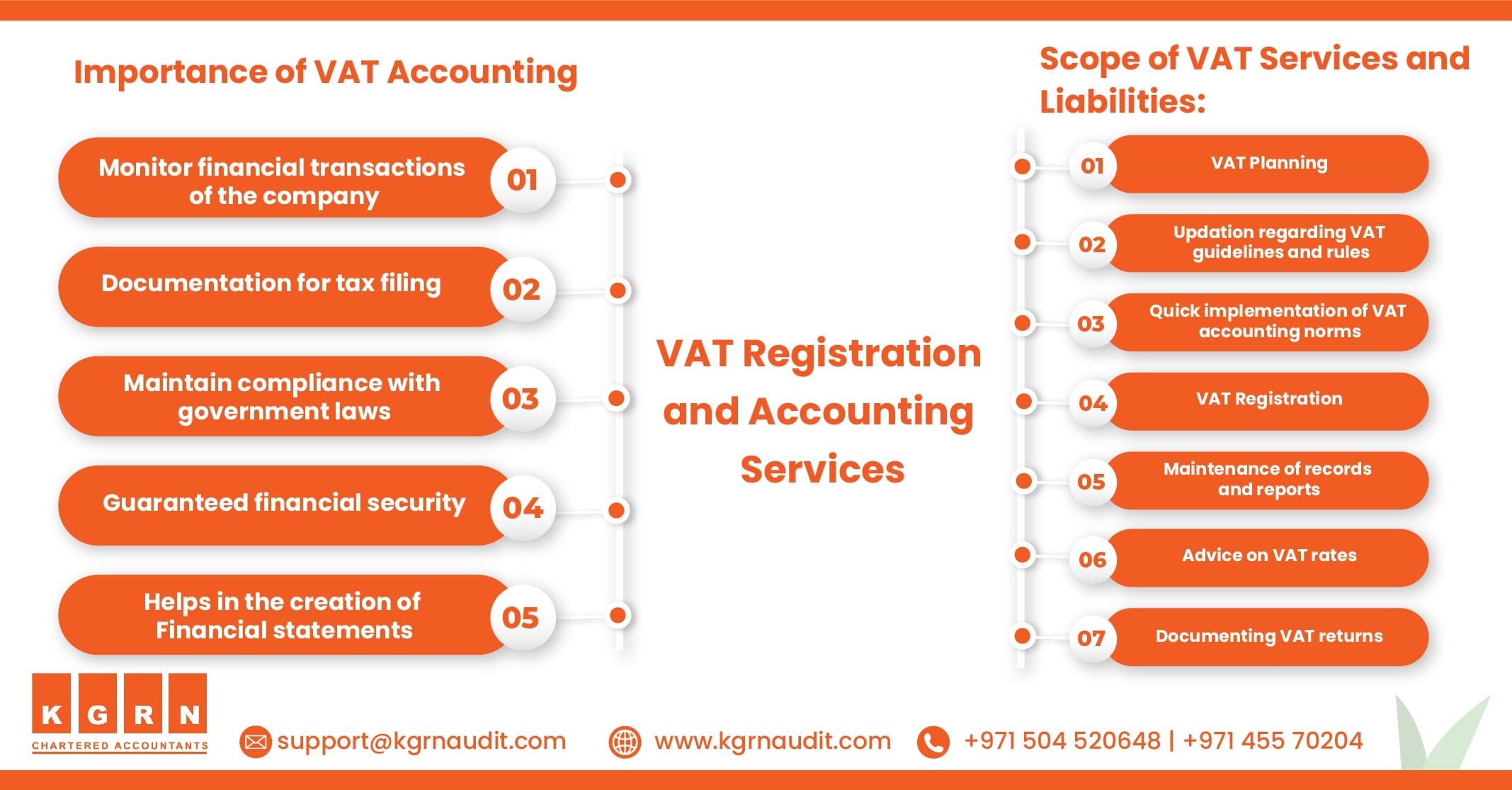

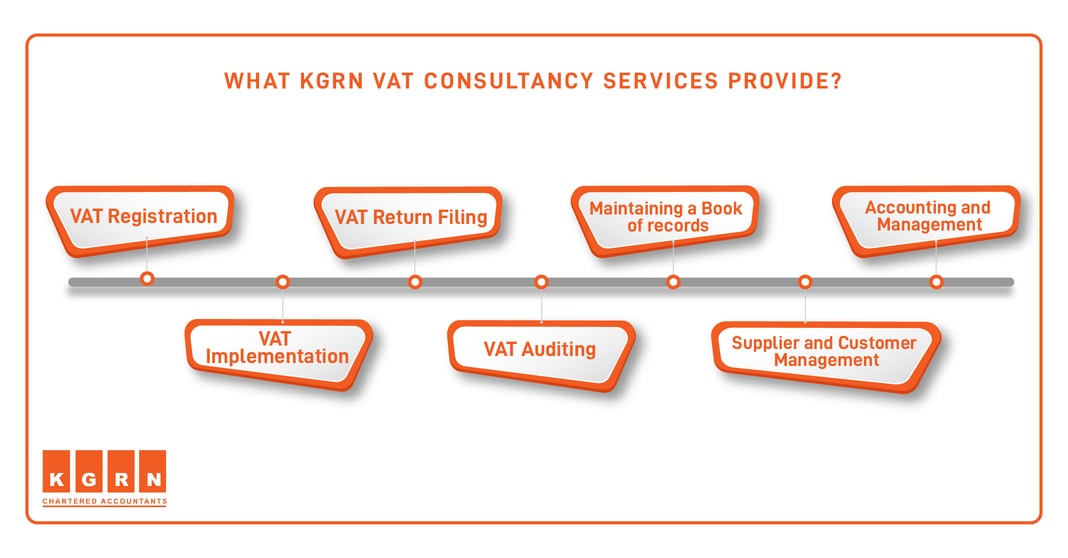

KGRN VAT Firms in UAE Offers

VAT Consultation/Advisory

Vat Consultancy Services In Dubai is the most significant feature of our service. It gives us the chance to fully recognize the day-to-day procedures of a client’s business, the type and volume of supplies they create their vat firms in Dubai inputs and outputs, the applicability of compact rates and exceptions, and their record-keeping volume. This allows us to measure how VAT relates to their business and identify the changes that are required to their surviving accounting systems and business processes.

VAT Registration in UAE

The VAT law says where you have to register for VAT and how you have to do it. It is important to keep track of which business activities are counted as taxable goods for VAT registration. Some businesses, like new ones that haven’t made any sales yet but have a lot of expenses, may find it helpful to sign up for VAT firms in Dubai on their own, so they can improve their input tax early. To avoid charges for late registration, it is also important to make sure that a company gets registered for VAT by the deadline.

The Federal Tax Authority (FTA) needs to see a number of papers as part of the process of registering for VAT. Putting up too few or wrong forms can slow down the clearance process. Some parts of the application also need to be filled out in Arabic. Our team has put together a simple worksheet with all of these forms and can show you examples of the different styles that the FTA requires. We say yes to a request only after we’ve gone through and checked all the certifications. These will help make sure that registering for VAT is quick and easy.

VAT Implementation in UAE

KGRN will take responsibility a legal analysis of every business area anticipated to be compressed by the VAT regulations to confirm that the operations and processes are wholly in compliance. There may be a need to revise the format of documents and the language used in contracts, and some businesses may need to reevaluate their pricing strategies to accommodate the impact of VAT firms in Dubai. In addition, it is essential to determine if a company’s current accounting system is able to process various forms of output and input VAT, as well as generate VAT return files and FTA Audit files in the accepted formats. Additionally, businesses will need to assess the impact of VAT on their cash flow and identify methods to mitigate the negative impact. KGRN can assist clients with all of these concerns.

VAT-compliant bookkeeping Service

Many of our customers outsource their whole vat accounting in Dubai function to KGRN. We confirm that clients’ books of accounts are efficient in a timely manner and all sales, purchases, and expense transactions are verified in full submission with VAT regulations. We will also prepare the statements and credit notes as per FTA-approved organizations. It is vital to charge the correct VAT amount on each appropriate supply and it is equally important to right input VAT only on allowable transactions under the VAT legislation. Mistakes in this respect may draw sudden penalties in the future. KGRN’s bookkeeping service also contains the preparation of financial accounts on a monthly basis, which contributions our clients to stay up-to-date with their business performance and financial position.

VAT Returns

VAT returns must be filed on a monthly or quarterly basis, dependent upon the size of the business. There are exact goals for these returns and incremental fines are applicable for default. These filings comprise a statement of standard-rated supplies, zero-rated supplies, exempt supplies, reverse charge transactions, imports, and relevant taxes. A well-maintained accounting organization and process is important to produce the correct figures with ease at the right time. KGRN can support clients with the right and timely filing of VAT returns, and can also provide supervision with the procedure of payment for amounts due.

VAT Recovery

Businesses, whose input vat firms in Dubai goes beyond their productivity VAT for the period, are permitted to seek repayment from the FTA. The FTA may request a description or further supporting documents before treating the refund. KGRN can communicate with the FTA on behalf of clients on all tax-associated matters. We can reply to FTA queries, submit requests for reexamination of FTA decisions, and support clients with any tax audits accompanied by FTA. Where suitable, can also apply for de-registration of VAT on a client’s behalf.

Advantages of KGRN VAT Firms in Dubai

- It has enlisted a new arm of expert VAT consultancy, equipped to confront the difficulties and openings. The Value Added Tax (VAT) is a type of assessment on utilization that applies to almost all products and ventures.

- Since the GCC governments have agreed to implement VAT, numerous organizations are currently at the alarm. UAE will receive the framework also from January 2018. Expense Help offers specific VAT counseling administrations to organizations all over Dubai.

- Our VAT Services in Dubai services have understood by UAE governments. They will commit themselves to give expense on utilization, techniques and execution intend to profit your business over the long run.

- Our Vat Services In UAE worldwide team VAT and GST experts can help preserve you compliant with your indirect tax responsibilities both at home and overseas. Our team of vat firms in Dubai distributes a service that reduces the complication and management burden that comes from operating in today’s business world.

- KGRN, with vat experts in UAE in more than 60 countries, is able to intensely reduce the management burden and save time on VAT and GST compliance. Our business model means we have depth knowledge of local best preparation, technology, and processes that endowments our clients’ transparency, control, and coordination whether they function in one market or many.

Our vat services in Dubai aid our clients stay well-informed of regulatory changes, at the same time as offering direct access to our local experts and a robust control outline that provides accuracy and devotion to reporting deadlines.

Related blog:

VAT Consultant in Dubai