The Economic Substance Test implemented by Economic Substance Regulation UAE helped bring more accountability to the taxation infrastructure in the UAE. It helped the country get off the EU’s tax Blacklist, and improve its credibility in the international market. ESR Notification UAE comes with two broad filing requirements that encourage companies to maintain an appropriate economic presence in the UAE. The Economic Substance Test is a part of these compliance formalities, and all eligible companies have to ensure they meet these requirements to stay on the right side of the law. In this article, we will take a look at the Economic Substance Regulations UAE Notification, and why it is so important.

What is the Economic Substance Test?

The Economic Substance Regulations UAE implemented the need for eligible companies to perform an Economic Substance Test. All onshore and Free Zone jurisdictions in and around the UAE have introduced and adopted a legal substance requirement. All business entities that meet the eligibility criteria mentioned in the Economic Substance Dubai guidelines will have to perform this legal substance requirement.

The Economic Substance Test requirement assists the entity in demonstrating how it reinvests profits earned back into the Emirati economy. These Economic Substance Tests will be implemented on January 1, 2019. These tests may differ slightly from jurisdiction to jurisdiction, but they are broadly similar in many ways.

What is Economic Substance Regulation in UAE?

The UAE introduced the Economic Substance Regulations UAE as a part of the OECD Inclusive Framework. The implementation occurred via a Cabinet of Ministers Resolution on April 30th, 2019. Further guidelines and amendments followed suit in 2019, and later on in August of this year. The Economic Substance Dubai guidelines require eligible onshore and Free Zone companies in the UAE to maintain various compliance requirements.

All companies that engage in Relevant Activities as defined by the ESR guidelines must abide by these filing requirements. These companies have to demonstrate that they are maintaining an adequate economic presence within the UAE with the help of these compliance measures.

What is Economic Substance Return?

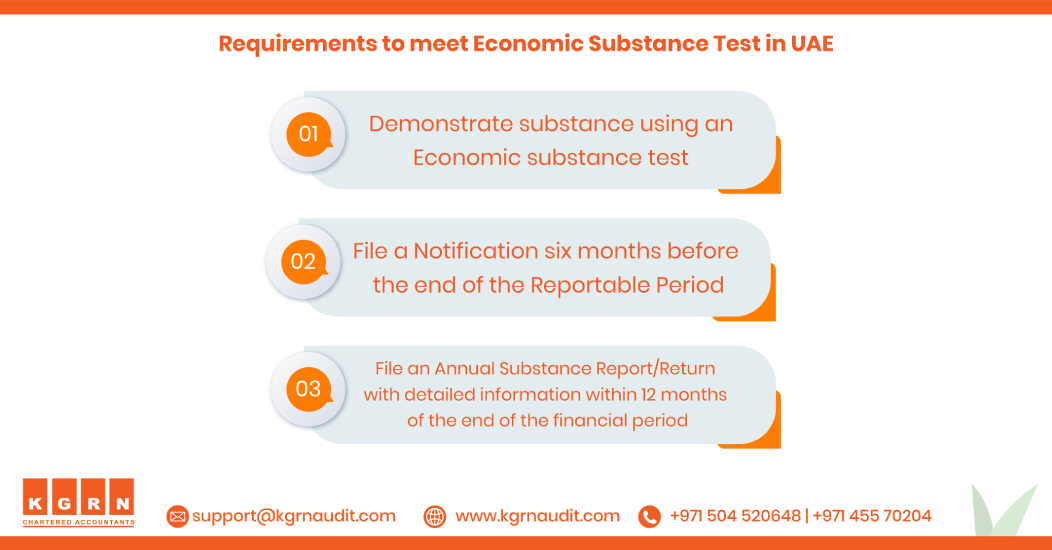

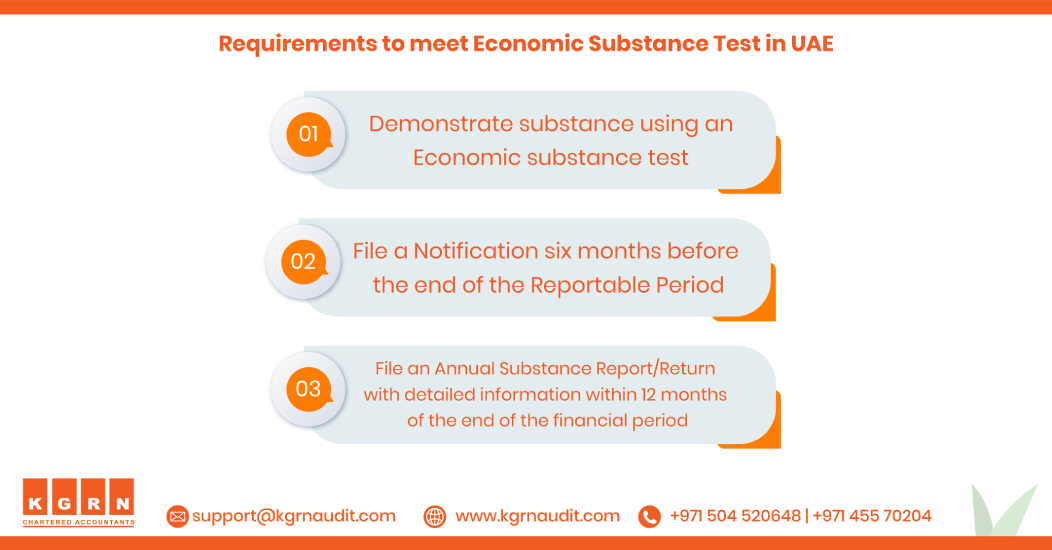

The Economic Substance Regulations come with two broad filing requirements. These regulations will apply to all financial years starting from January 2019. All commercial entities that fall within the scope defined by the Regulations must abide by the following compliance formalities;

- Submit an annual Economic Substance Regulations UAE Notification form annually.

- Submit an Economic Substance Report on an annual basis.

While the notification must be filed to the concerned Regulatory Authority annually, the report must be filed at least 12 months before the end of the financial year. Hence, all businesses whose financial year ends on December 31st, 2019 must file their ESR report by December 31st, 2020.

Who all need to perform an Economic Substance Test?

All onshore and Free Zone business entities that engage in the following Relevant Activities must undertake an Economic Substance Test as per ESR in Dubai.

- Banking

- Insurance

- Investment Fund Management

- Lease – Finance

- Headquarters Business

- Shipping

- Holding Company

- Intellectual property Business

- Distribution and Service Centre

What is the meaning of Economic Substance?

Economic substance is a taxation law doctrine that is prevalent in various countries around the world, including the USA and countries in the Middle East. In essence, it is a quality that a transaction possesses other than the reduction of tax liability that leads to a positive economic effect. Additionally, it provides every transaction with the quality other than a mere tax effect. The doctrine helps the Tax department determine whether companies are bypassing or abusing tax laws to reduce their tax liability.

According to this philosophy, in order for a transaction to be regarded relevant and respected, it must have a significant impact on the economic status of the taxpayer. In light of this, it is necessary for every transaction to have some effect in addition to the effect that it has on the ordinary income tax. As a consequence of this, the transactions in question will have an economic substance, which will result in a good influence on the economy and positive growth.

Is the income earned from the relevant activity subject to tax outside the UAE?

An entity that did not generate any income from a relevant activity during a particular financial period does not have to meet the Economic Substance Test. They are also not required to file an Economic Substance Report for that particular financial period. However, all such businesses will have to submit an ESR Notification form.

The UAE-based branch of a foreign company engaging in a Relevant Activity must comply with the ESR Regulations unless the income generated falls under taxation in the foreign region. Similarly, if an Emirati business engages in a Relevant Activity via a branch registered in another country, the Emirati business does not have to consolidate the actions of this branch. The income generated by this branch may be left out if that income is subject to taxation in the foreign jurisdiction wherein it is earned.

What is ESR filing?

All Licensees will have two broad ESR filing requirements under the Regulations which are as follows;

- ESR Notification form annually

- ESR Report or Return

Economic Substance Requirements

Licensees that engage in a Relevant Activity must file a Notification at least six months before the end of the financial period. Additionally, licensees who earn an income through engagement in a Relevant Activity must file an Economic Substance Report. The company must file this report at least 12 months before the end of the financial period. For every relevant financial period, the Economic Substance Requirements mandate that eligible companies demonstrate substance via an Economic Substance Test. An Economic Substance Test demonstrates the following;

- Licensee directs and manages the Relevant Activity within the UAE

- Core Income Generating Activities occur within the UAE

- Licensee hires adequate people, has the required premises and expenditure in the UAE.

Failure of any business entity to comply with the rules stated in the ESR guidelines will have to face fines and penalties. Continued non-compliance can lead to penalties, administrative sanctions such as revocation, suspension, and non-renewal of the business’s trade license.

For more detailed information about ESR, Visit: Economic Substance Regulations(ESR) Guidelines

In case you need any help maintaining your ESR compliance, feel free to reach out to KGRN Chartered Accountants for expert help.

Our Services

ADNOC ICV Certification Agencies