Every firm that operates in the UAE must ensure that it satisfies all compliance standards. This not only increases the firm’s credibility and trustworthiness, but it also helps the company avoid legal difficulties. However, because company rules and taxation regimes change regularly, it is difficult for businesses to remain up to speed on risk and compliance laws. As a result, most business consulting organizations now provide Corporate Governance, Risk, and Compliance Services. In this post, we’ll look at the significance of Corporate Governance, Risk, and Compliance Services and how KGRN can assist you with these.

What is Corporate Governance, Risk, Compliance?

Corporate Governance, Risk, and Compliance refers to the processes that businesses must follow in order to maintain the compliance measures of the jurisdiction in which they operate. Risk services can contribute in decision-making, whilst governance activities guarantee that the company has a lean and efficient corporate structure. High levels of Corporate Governance, Risk, and Compliance assist to guarantee that firms are long-term viable and profitable. Following excellent Corporate Governance, Risk, and Compliance policies also aids in convincing investors and shareholders that the firm is doing well for itself.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

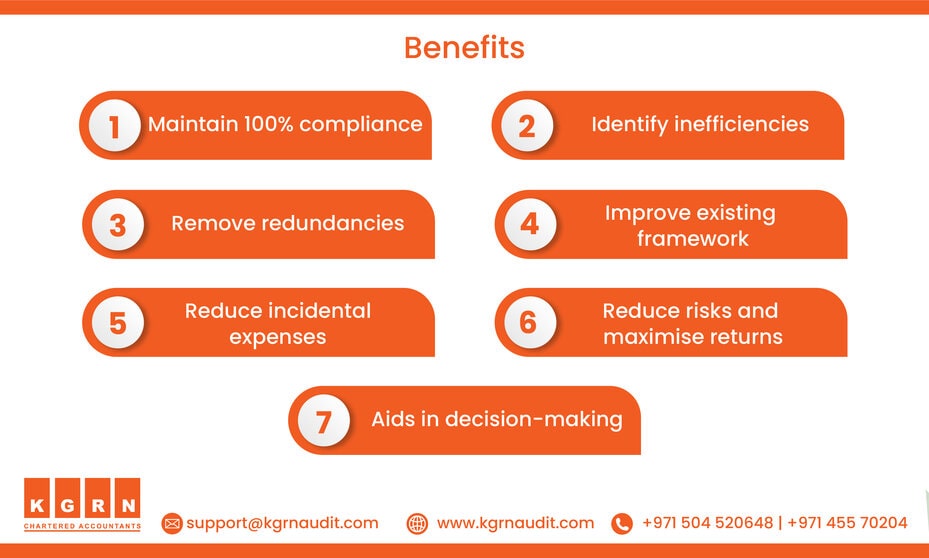

Benefits of Corporate Governance, Risk, Compliance in the UAE:

- Ensure 100% compliance at all times

- Identify inefficiencies in the existing framework and make improvements

- Reduce incidental expenses and wastage of resources

- Create a more streamlined corporate governance model

- Reduce risks and maximise returns

- Helps you make the best business- decisions by providing you with all the information you need

- Make your business more credible and trustworthy to investors and shareholders

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Steps Involved in Corporate Governance, Risk, Compliance in the UAE:

Here’s a look at the steps involved in Corporate Finance Consulting in the UAE;

- Most experts will start by talking to higher management and understanding the requirements of a business.

- They will run an internal audit of the governance framework to know how the company functions and the true nature of the business.

- Next, financial experts will run a GAP analysis to help identify inefficiencies and redundancies in the corporate governance framework in place.

- Afterwards, the experts will go through the financial reports of the company and ensure that it is economically viable.

- In case the company is planning a merger or acquisition, the experts will help with a risk analysis to aid the management in taking the best possible decision.

- After gaining all the insight they need, the experts will draft a new plan to improve the efficiency of the Corporate Governance structure in place.

- During this phase, a team of financial experts and CAs will also go through the company’s reports to make sure that it is filing all the required returns.

- They will also do a quick audit to ensure that the practices of the company are following the compliance laws set by the Emirati government.

- Lastly, the team will help implement the changes and do a thorough analysis to ensure that all the requirements set forth by the company are met.

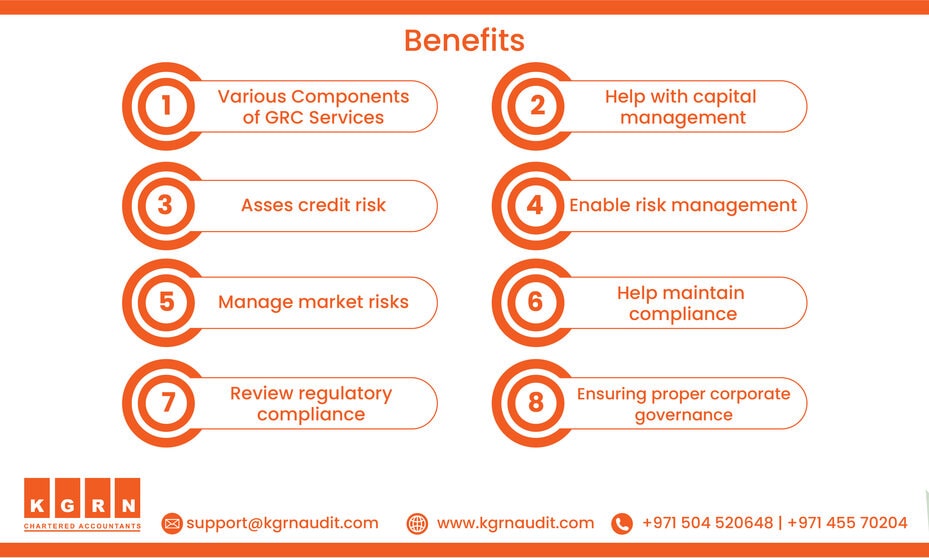

KGRN Corporate Governance, Risk, Compliance Services in the UAE:

KGRN is one of the most renowned Audit, Accountancy and Business Consultancy firms in the UAE. Therefore, our experts have the experience required to ensure that you meet all the required compliances. Furthermore, our team can also guide you on all matters to do with risk analysis and corporate governance to ensure that you make the right business choices and maintain compliance at all times. KGRN also provides timely and efficient service, ensuring your company files the proper returns and always remains adequate and efficient.

Here is a quick look at the various Corporate Governance, Risk and Compliance Services KGRN provides;

- Conduct a GAP analysis to find issues with the current corporate governance framework

- Help develop a robust and efficient governance framework

- Create data packs, checklists, and maintain updated documents regarding reporting standards your company is expected to follow

- We help implement the right corporate governance framework in the best way possible

- Our team also helps with drafting the most appropriate policies, guidelines and standard operating procedures for your business.

- When it comes to risk management, our team will help with the assessment of risk appetite, creation of risk reports and also help you manage your risks efficiently.

- Keep you updated regarding new laws and ensure you maintain compliance at all times

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Why KGRN?

- We take the time to truly understand the size and complexity of your business so that our solutions feel tailor-made for your company.

- We have a simple, yet elegant and business-friendly approach which leads to a quick resolution of all issues and queries

- We offer adaptable and flexible services that will help you with all your legal requirements

- We maintain a high level of privacy regarding your details

- Full-time access to all our experienced staff

- Our services will help you minimize risks and maximize returns on every project and deal

- We provide the most competitive process to ensure that companies of all sizes can

make use of our service

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Frequently Asked Questions

Why are Corporate Governance, Risk, and Compliance Services important?

Since the GRC guidelines keep evolving in today’s complex business environment, businesses

need help ensuring they stay on the right side of the law. Such services help companies stay on

the right side of the law and stay updated regarding changes in laws and regulations. They also

ensure that the business remains credible and trustworthy to investors and creditors. Such

systems also help in improving the overall flexibility and transparency of companies.

Why does corporate governance matter?

- Promotes the sound management of your business

- Puts creditors, investors and shareholders at ease

- Meet all regulatory expectations successfully

- Mitigate risk to the maximum

- Protect the interests of clients, creditors, investors and shareholders at all times

- Promotes long-term sustainability

- Sets the tone for a business adapts and evolves

How to minimize the risk associated with business deals?

- Ensure your in-house team has the required experience

- Conducting a gap analysis to ensure where your business needs to improve

- Go through your financial records to analyse your fiscal position

- Remove all compliance-related risks

- Identify, monitor and manage all risks with the help of GRC services

For enquiries, call +971 45 570 204 / E-mail: [email protected]