Accounting Advisory Services In UAE

Accounting Advisory Services:

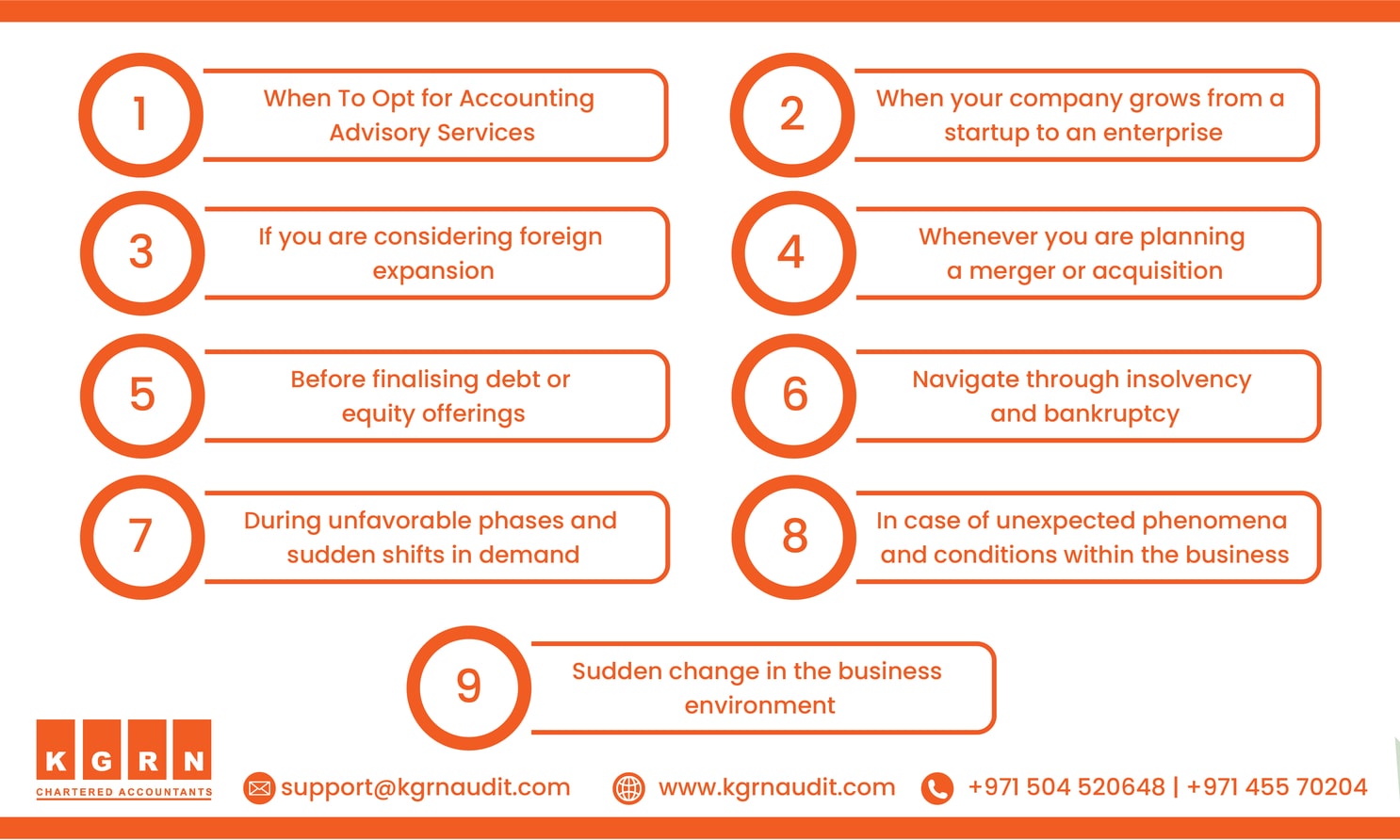

Automation has changed the way the world makes, including the field of accounting. However, the inherent value that an accountant adds has not changed. While certain tech companies debate the need for accountants in today’s world, it is clear that automation cannot make accountants irrelevant. Accounting Advisory Services help companies around the world maintain internal controls, meet compliance requirements and improve their bookkeeping and auditing. In this article, we will take a look at how automation cannot trump Accounting Advisory Services, and how KGRN helps with the same.

What are Accounting Advisory Services?

Accounting Advisory Services are all the primary runs and checks that accounting firms provide companies to ensure all their financial processes are legit. It also involves all the preliminary reviews and analyses done to ensure companies meet specific compliance requirements. Furthermore, such advisory services also help with the preparation of financial reports, reviewing internal processes and establishment of an accounting framework. Hence, experienced and valued accountants are no longer bookkeepers and audits but have become business partners through their valuable and trusted counsel.

Benefits of Accounting Advisory Services in the UAE:

1. Experienced accountants can provide information that aids in smart and well-informed decision-making.

2. Provides trusted counsel at the time of mergers and acquisition so that companies make the best possible decision.

3. Helps with risk assessment and management of internal processes.

4. Aids in improving the overall financial and accounting framework of the business

5. Significantly enhance productivity and efficiency of accounting processes

6. Reduces human error by identifying gaps and issues with the system in place

7. Promptly suggest changes and improvements to create a sustainable and feasible accounting framework

Steps Involved in Accounting Advisory Services in the UAE:

The COVID-19 pandemic has proven and justified the need for such accounting advisory services as it helps companies make high-stakes decisions. Here’s a quick look at how such Accounting Advisory Services work.

1. A team of expert accountants will first go through company records to understand the nature of the business.

2. Next, the team will assess current performance and analyze the processes in place.

3. Additionally, they will identify gaps within the framework in place, which leads to inefficiencies.

4. Once all the gaps are identified, the accountants will brainstorm ideas on how to close these gaps and create a more robust framework.

5. They will also take a look at specific issues, such as navigating tricky laws, applying for aid initiatives and benefit schemes and controlling revenue loss. This is especially true in case of unexpected events, such as the recent pandemic.

6. Finally, they will draft reports regarding the internal controls and bookkeeping methodology of the company.

7. After helping implement the changes and improvements suggested, such a team of experts will also continually review the system to ensure it maintains compliance and stays effective.

KGRN Accounting Advisory Services In the UAE:

At KGRN, we provide clients with a highly effective, personalized service that covers every accounting and auditing need your company will have. Thanks to our excellent service, timely delivery, and affordable prices, we have been recognized as Dubai’s top audit and accounting

firms year after year. We bring to all our customer’s service of the highest quality, which is customizable customizable, ensuring that you never have to worry about your records ever again. Some of the Accounting Advisory Services we provide are;

1. Identify the possible issues and risks

2. Create a detailed plan to handle such problems

3. Help in making the right business plans

4. Provide financial and non-financial reports.

5. Analyze finance Analyze formation and gain insights

6. Help you monitor and project cash flow.

Why KGRN?

● We help provide you with international market exposure, and our team of experienced professionals will give top-notch business advice

● We have a simple, yet elegant and business-friendly approach which leads to a quick resolution of all issues and queries

● We offer adaptable and flexible services that will help you with all your legal requirements

● We maintain a high level of privacy regarding your details

● Get a comprehensive analysis of all your business processes and operations to identify gaps in efficiency.