IFRS Advisory Services In UAE

IFRS Advisory Services:

Expansion to international markets and dealing with such large-scale deals require you to follow the highest standards of accounting. IFRS is a global financial reporting standard that countries all around the world accept and embrace. As a result, most companies follow this protocol to ensure that they meet compliance and have the right documentation. However, the system often revisits and changes its rules and guidelines resulting in confusion and the need for IFRS Advisory Services. Here is a look at why IFRS Advisory Services are so essential, and how KGRN can help you maintain IFRS compliance.

What is IFRS Advisory?

IFRS stands for International Financial Reporting Standards, and these serve as a basic guideline for preparing financial statements. These common rules are applicable across the globe helping make financial statements consistent, credible and comparable. The International

Accounting Standards Board, commonly called IASB, is responsible for issuing the IFRS protocol. IFRS also serves as a global language that encourages and promotes business affairs with the highest credibility and transparency. As a result, to maintain efficient and sound

financial reporting standards, companies need to make sure they follow the IFRS protocols.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

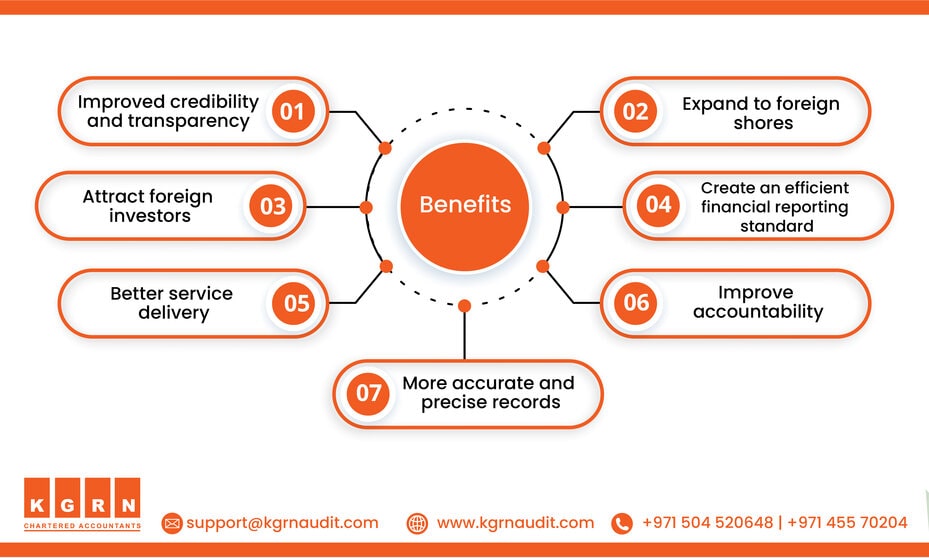

Benefits of IFRS Advisory Services in the UAE:

1. Improved credibility, comparability and transparency of financial reports

2. Helps a company expand to foreign shores and grow their business

3. Makes it possible to attract foreign investment as it serves as a credible source of financial information

4. Helps establish a more robust, more efficient financial reporting standard that allows for better delivery of services

5. Improves accountability, which leads to improved credibility amongst shareholders and investors

6. Enhances the company's reliability on financial statements as they are more accurate and precise

7. Helps in improving the overall decision-making process, allowing companies to make better-informed decisions

8. Makes VAT reporting and compliance manageable and straightforward

9. Helps in avoiding the confusion that arises due to increasing complexity of reporting standards and variation in their guidelines

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Steps Involved in IFRS Advisory Services in the UAE:

1. Most companies will do an internal audit of the company to gain an understanding of how the company works and what the nature of its business is.

2. Furthermore, they review the internal processes of the company with the changes made in the IFRS guidelines to find gaps within the system.

3. The team will then discuss with the higher management to find a plan to solve complicated IFRS issues.

4. Experts will also aid with the preparation of IFRS-compliant financial statements and records.

5. The IT department then reviews the changes required and then gears up for implementation of the proposed IFRS strategy.

6. A contingency plan is also drafted to help with addressing all the issues that might arise as a result of the implementation or if something goes wrong.

7. The team will also have to continually review the system to ensure that it maintains compliance and follows the best practices.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

KGRN IFRS Advisory Services in the UAE:

At KGRN, we provide clients with a highly effective, personalized, and secure service that covers every accounting and auditing need your company will have. Thanks to our excellent service, timely delivery, and affordable prices, we have been recognized as one of Dubai’s top audit and accounting firms year after year. We bring to all our customer’s service of the highest quality, which is customizable and reliable, ensuring that you never have to worry about your records ever again.

Also, our experience working with all sorts of companies of varying sizes and nature helps us have the expertise required to guide you with regards to IFRS policies and guidelines. We can help you implement a good IFRS-compliant system while also analyzing your in-house

processes and operations. As a result, our experts can help you identify gaps, remove redundancies and improve overall efficiency and productivity.

Some of the services related to IFRS Advisory that KGRN provides is as follows;

1. Help with IFRS adoption and protocol implementation

2. Constant review and analysis to ensure you stay IFRS compliant

3. Assistance with switching to complex standards like IFRS 15 and IFRS 9

4. Do through GAP analysis to promote the usage of high-standard

5. Set up the required internal processes to ensure smooth switch and transition

6. Help in training the staff and ensuring an efficient transfer of knowledge and experience

7. Assistance with preparation of required reporting manuals

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Why KGRN?

● We help provide you with international market exposure, and our team of experienced professionals will give top-notch business advice

● We have a simple, yet elegant and business-friendly approach that leads to a quick resolution of all issues and queries

● We offer adaptable and flexible services that will help you with all your legal requirements

● We maintain a high level of privacy regarding your details

● Get a comprehensive analysis of all your business processes and operations to identify gaps inefficiency.

● We provide the best strategies that help with IFRS adoption, implementation, review, research and support.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Frequently Asked Questions

What do IFRS Advisory Services help with?

FRS Advisory Services help enable the following;

1. Plan, strategize, implement and develop an IFRS compliant system

2. Continually evaluate your system to ensure it sticks to the guidelines

3. Developing a strategy that promotes sustainability

4. Help with drafting IFRS policies

5. Identify gaps in the present system and suggest ways to overcome them.

Why does the IASB prescribe IFRS rules?

Businesses are growing at a faster rate than ever before and are expanding across the

boundaries of countries. As a result, having multiple accounting standards make it difficult to

compare financial records as each nation can have a different system. Hence, having a

standard set of rules and policies make it easier to share relevant information transparently.

Why do companies need advice on IFRS Standards?

The main reason companies approach IFRS Advisory Services are for the following benefits;

1. Improvement of credibility and transparency

2. Improves accountability of the companies

3. Reduction of information gap between shareholders and management

4. Improves overall efficiency

5. Avoid confusion that arises out of following different standards

For enquiries, call +971 45 570 204 / E-mail: [email protected]