Governance, Risk, and Compliance standards also include keeping an eye on and controlling the risks that come with money laundering. It is necessary to follow these rules so that the UAE stays an investor-friendly place to do business. There are hundreds of financial companies in the Dubai International Financial Centre, which is now one of the top ten financial centers in the world. However, this also makes the UAE a target for thieves who want to take advantage of the large amount of money there. Through the Dubai Financial Services Authority, the DIFC takes a number of legal steps to deal with these threats. These pages will talk about why anti-money laundering services are important and how KGRN can help with them.

What are Compliance and Anti-Money Laundering Services?

The regulations and guidelines pertaining to the mitigation of money laundering risks are under the jurisdiction of the DFSA. In addition, legislation safeguards businesses against additional financial offenses that may occur within economic zones. Therefore, it is imperative that all financial institutions operating within the UAE are cognizant of these anti-money laundering risks and make every effort to avert them. In response, an increasing number of audit and business consulting firms offer anti-money laundering and compliance services in the UAE. The DFSA functions predominantly as the regulatory agency for financial services overseen by the DIFC. It contributes to the protection of the DIFC and the economic ecosystem of Dubai against money laundering and financial offenses. Banks, credit services, insurance companies, Islamic finance institutions, asset management firms, and investment funds are all subject to DFSA regulations.

For enquiries, call +971 45 570 204 / E-mail: [email protected].

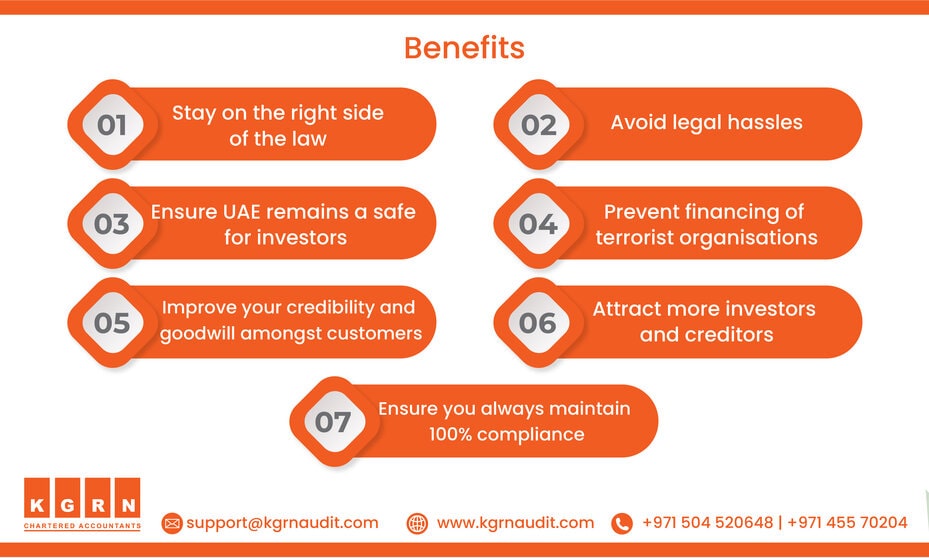

Benefits of Compliance & Anti-Money Laundering Services in the UAE:

- Stay on the right side of the law and avoid legal hassles

- Ensure that the UAE remains a safe place for investors

- Prevent the bifurcation and financing of terrorist organisations

- Improve your credibility, trustworthiness and goodwill amongst customers

- Attract more investors and creditors

- Build sustainable relationships with clients and other financial institutions

- Ensure you always maintain 100% compliance

Steps Involved in Compliance & Anti-Money Laundering Services in the UAE:

- A team of experts will go through your documents and records to gain more understanding of your business operations.

- They will then analyse your financial records to understand the flow of money, transaction history and accuracy of records.

- The team will then advise the company on a risk-based approach to prevent money laundering. They will then help the company develop a unique AML/CFT program that will minimise the risk of money laundering.

- The team will then implement a system that ensures customer due diligence to verify accuracy.

- The system will also have to monitor transactions, screen customers and maintain appropriate compliance with said rules.

KGRN Compliance & Anti-Money Laundering Services in the UAE:

KGRN is recognized by many in the UAE as a leading firm specializing in audit, accounting, and business consulting. As a result, our specialists possess the necessary expertise to guarantee that you adhere to every necessary compliance. In addition, our team can provide comprehensive guidance on the establishment and operation of an anti-money laundering system, guaranteeing the protection of your organization against such fraudulent activities and criminal activities. KGRN also guarantees timely and effective service, ensuring that all suspicious activity reports are transmitted to the appropriate authorities in a timely manner and that all AML systems operate efficiently.

What KGRN can help you with

1. Help with creating compliance policy and procedures

2. Draft a Compliance Monitoring Plan

3. Help with Transaction Monitoring Advisory

4. Analyse and review Regulatory Returns

5. Conduct Corporate Training

6. Compliance In-Sourcing services

7. AML support and auditing

We can also help with your AML support in the following ways;

1. Review current AML policy and suggest improvements

2. Assess the governance and compliance regarding your AML system

3. Review client files and check for customer due diligence

4. Guide monitoring suspicious activity

5. Provide experts advice on AML training to fit your requirements

For enquiries, call +971 45 570 204 / E-mail: [email protected]

KGRN Compliance & Anti-Money Laundering Services Branches in the UAE:

- Compliance & Anti-Money Laundering Services in Dubai

- Compliance & Anti-Money Laundering Services in Abu Dhabi

- Compliance & Anti-Money Laundering Services in Sharjah

- Compliance & Anti-Money Laundering Services in Fujairah

- Compliance & Anti-Money Laundering Services in Ajman

Why KGRN?

Our distinctive features, which help us provide you with the best possible service include the following;

- We offer the best web-based compliance and AML solutions in the UAE

- Our system helps keep you in the loop at all times

- We offer the best services at the most competitive prices.

- Our team of experts will guide you through every step of the process, helping make the transition as smooth as possible.

- Our team will help you stay updated regarding new laws and amendments to ensure that you always maintain compliance.

- We will help you create a flexible AML system that is sustainable and scalable.

Anti-money laundering regulations come through federal legislation, after recommendations

from the Financial Action Task Force. Some of the common legislation against AML in Dubai

are as follows:

- Federal Law 4 (2002): To combat money laundering and financing of terrorism crimes

- Federal Law 1 (2004): Decree on fighting terrorism offences

- Federal Law 20 (2018): Regarding Anti-Money Laundering, Financing Illegal

- Organizations

- DIFC Regulatory Law (2004): Specific AML/CFT regulations

What should a sound AML system contain?

- Ensure customer due diligence

- Verify details from customers

- Monitor customer suspicious transactions

- Screen customers appropriately

- Appoint a compliance officer or money laundering reporting officer

- Submit suspicious activity reports if required

- Ensure that your systems meet the AML rulebook requirements.

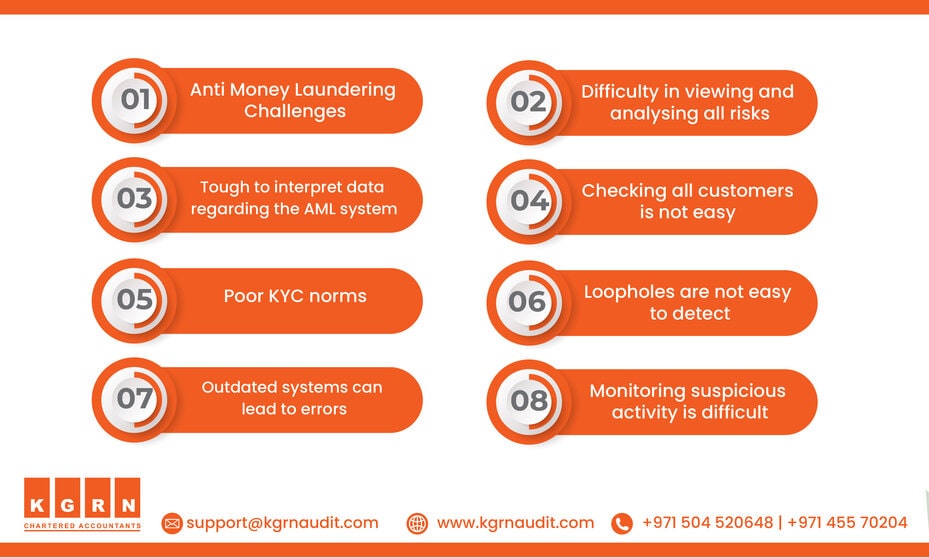

What are Anti Money Laundering Challenges?

- Difficulty in viewing all risks

- Not easy to interpret the data regarding the AML system

- Checking all customers is not easy when there is a large volume with regards to customers.

- Poor KYC norms

- Loopholes are not easy to detect