Managing successful companies in more than one country! Not only does this significantly increase the complexity of operations, but it also requires you to maintain compliance with more rules and guidelines. Furthermore, managing the taxation laws and guidelines of both countries can be a daunting task. Also, in case you have a successful business and earn an income from both countries, you might have to pay tax in both countries unless you are careful. However, KGRN can help you with avoiding such hassles by handling your Tax Residency Certificate Application. So, what is the TRC in the UAE, and why is it so important? Here’s a look at everything you need to know about the Tax Residency Certificate in UAE, and how KGRN can help you with it.

What is the Tax Residency Certificate?

The Tax Residency Certificate in the UAE is a document provided to business owners and entrepreneurs to help prevent double taxation. This document is applied for by individuals who are paying taxes in another country, wherein they have an income due to a business. As the UAE is a part of several Double Tax Avoidance Agreements with other countries, having such a certificate helps them avoid being taxed in both countries. Business owners can, therefore, avail of tax benefits by obtaining the Tax Residency Certificate.

Who Should Obtain the Tax Residency Certificate?

Any individual, especially those who own companies or business enterprises and meet specific eligibility criteria, can apply for the Tax Residency Certificate. Furthermore, even onshore and free zone companies in the UAE can apply for a Tax Residency Certificate. However, Offshore Companies cannot apply for the same, as they are not residents of the UAE. Also called the Domicile certificate, the International Financial Relations and Organisations Department handles the issuing of such certificates in the UAE.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Eligibility Criteria for Tax Residency Certificate in UAE

- Must be a resident of the UAE for a minimum of 180 days

- In case a company applies, it must have functioned within the UAE for at least one year

- Must have a valid and registered email ID and account with the Ministry of Finance

- Non-residents cannot apply for the Residence or Domicile Certificate in the UAE

- Branches of foreign companies cannot apply for a TRC.

- Non-employed individuals, such as spouses of salaried individuals, cannot apply for a Domicile Certificate.

Documents Required for Tax Residency Certificate in UAE

For Individuals:

- Passport

- Valid Residence Permit and ID Proof

- Residential lease agreement/Rental Agreement or Registration Certificate

- Authorised bank statements of the last six months

- Salary Certificate

- GDRFA issued Exit and Entry report

- Tax forms of the country wherein the Domicile Certificate will be submitted

For Companies

- Trade license

- Partners’ attachment

- Certified Establishment Contract

- Passport copy of the owners, partners and directors

- ID proof copy of the owners, partners and directors

- Residence permit copy of the owners, partners and directors

- Audited financial accounts

- Authorised bank statements of the last six months

- Verified lease agreement

- Details regarding the company’s organizational structure

For enquiries, call +971 45 570 204 / E-mail: [email protected]

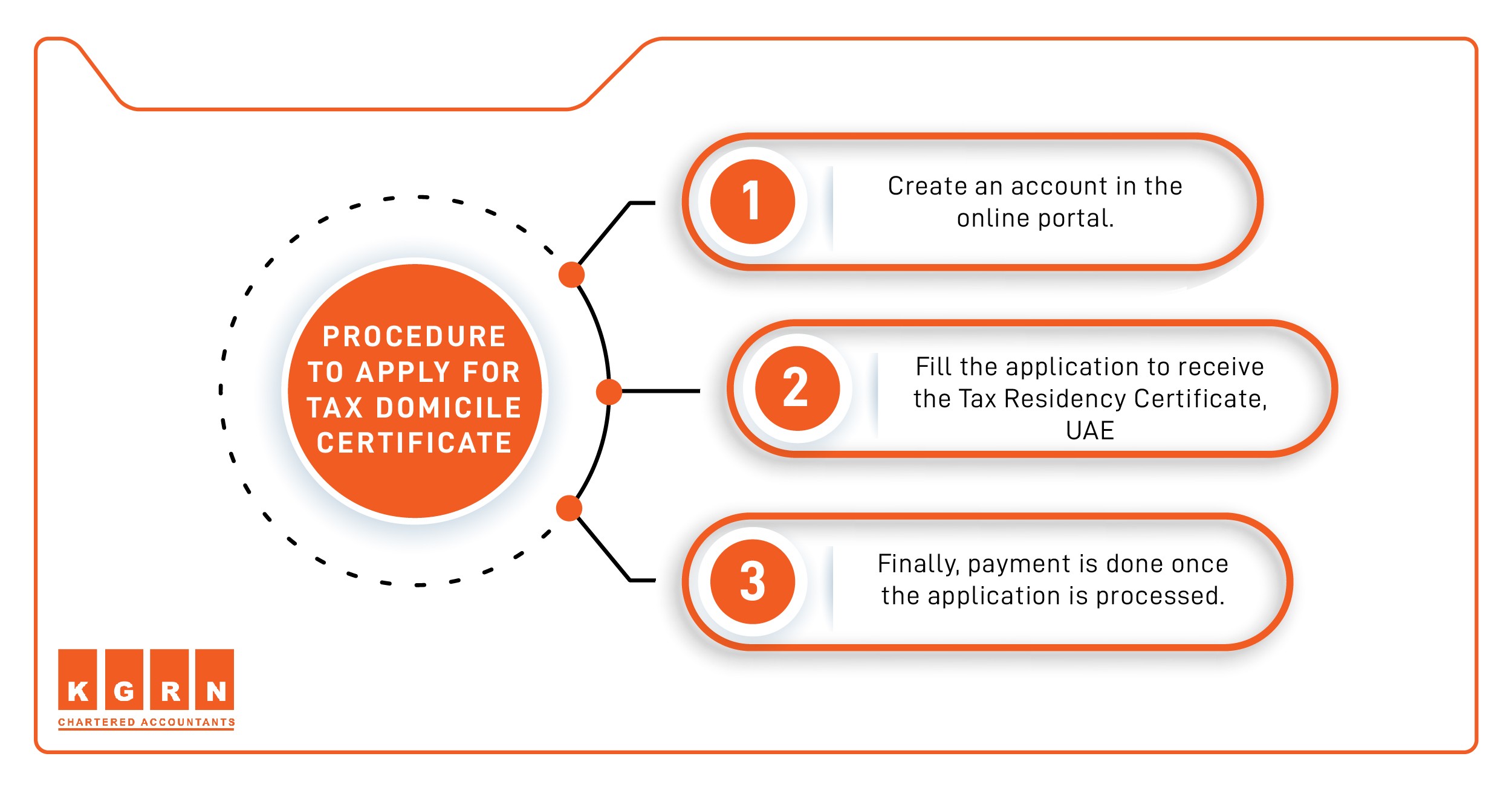

Applying for the Tax Residency Certificate in the UAE

- First and foremost, you need to ensure that you or your company meets the eligibility criteria mentioned above.

- In case you do qualify, you can approach the Ministry of Finance. Visit official portal, and from the homepage, you should navigate to the Application section.

- From there, you must fill out the form for the Tax Residency Certificate and submit the same after careful verification.

- Also, you must be ready to submit all the supporting documents required, and you can upload the same through the portal.

- The Ministry of Finance will then conduct an extensive review of your documents and application, which may take anywhere between 2 to 4 weeks.

- Furthermore, you must also complete the payment of the required fees through the payment methods listed on the website.

- After successful verification, the Tax Residency Certificate will be made available to you.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Things to Know About the Tax Residence Certificate

- The entire process takes around 14 to 21 days.

- Once completed, the Tax Residency Certificate is sent to you via your registered email-ID.

- Once you receive the certificate, it will remain valid for a year from the date of issue.

- While Onshore, Mainland and Free Zone Companies can apply for the Domicile Certificate, Offshore companies cannot, as they are not regarded as residents of the UAE.

- However, Offshore companies do have the option of applying for a Tax Exemption Certificate, in place of the TRC.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Benefits of Obtaining the Tax Residency Certificate in the UAE:

- Avail of tax benefits associated with Double Taxation Avoidance Agreements.

- Helps avoid having to pay higher taxes, enabling you to save on valuable resources.

- In case you are a part of the CRS group of nations, the TRC helps with maintaining compliance.

- Allows you to claim excess taxes paid.

- Protects the national economy by ensuring fairness for both taxpayers and the government.

- Builds credibility and transparency for the company involved.

- Proves residency in the UAE, helping establish authenticity.

Our team of expert professionals at KGRN can help you with every step of the process, enabling you to obtain the certificate with ease. We focus on customer satisfaction and do everything in our power to make sure you receive the best possible service. Furthermore, it is our commitment towards our clients and our strong work ethics that have enabled us to become one of UAE’s best tax accounting, bookkeeping and audit firms. With decades’ worth of experience in the field of finance and compliance in the UAE, our team will surely help you with every need you might have. We also go the extra mile to ensure the timely delivery of services and bring you the best service at the most reasonable prices. So, partner with us, at KGRN, and lay to rest all your worries regarding taxation and compliance.

For enquiries, call +971 45 570 204 / E-mail: [email protected]

Why KGRN?

- Efficient processing that ensures you receive all the deliverables on time

- Assistance and guidance from highly-qualified professionals

- Experience of having worked with countless companies, big and small, in the UAE

- Reasonable and competitive pricing to ensure everyone can afford our services

- Streamlined internal communication to ensure you stay updated every step of the way

- Deep-rooted commitment towards customer satisfaction

- We go the extra mile to make sure that you always have support from our end

- Provide you with data-driven insights which help you make well-informed business decisions